Building a diversified portfolio is a fundamental strategy for investors aiming to manage risk and achieve long-term financial goals. A well-diversified portfolio includes a mix of different asset classes, sectors, and geographic regions, which helps to mitigate the impact of market volatility on overall investment performance. This comprehensive guide will walk you through the steps and considerations for creating a diversified portfolio, providing you with the tools to make informed decisions.

Understanding Diversification

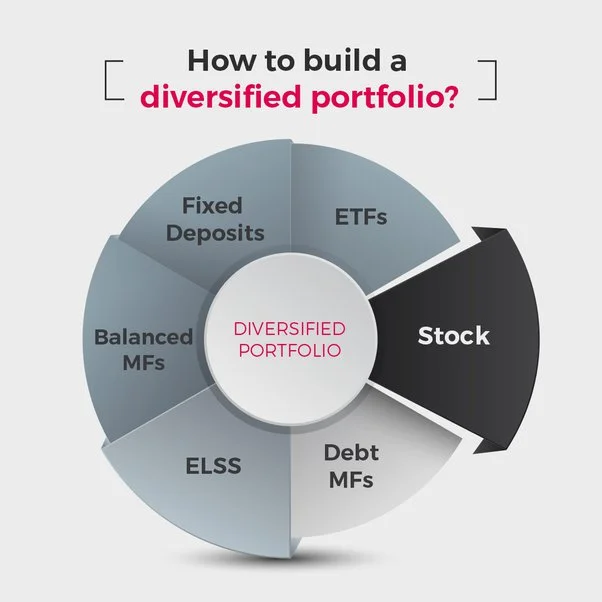

Diversification involves spreading investments across various assets to reduce the risk of a significant loss from a single investment. By holding a variety of investments, you can protect your portfolio against downturns in any one sector or asset class. Diversification can be achieved in multiple ways:

Asset Class Diversification: This includes stocks, bonds, real estate, commodities, and cash.

Sector Diversification: Investing in different sectors of the economy such as technology, healthcare, finance, and consumer goods.

Geographic Diversification: Including international investments to hedge against country-specific risks.

Step-by-Step Guide to Building a Diversified Portfolio

1. Assess Your Financial Goals and Risk Tolerance

Understanding your financial goals, investment horizon, and risk tolerance is crucial. Your goals might include retirement savings, purchasing a home, or funding education. Your risk tolerance will determine the proportion of high-risk, high-reward investments versus more stable, lower-risk assets.

Short-term Goals: If you need the money within five years, prioritize liquidity and stability, such as bonds and money market funds.

Long-term Goals: For goals 10 years or more away, you can afford more risk with a higher allocation to stocks and real estate.

Determine Your Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset categories. The right mix depends on your financial goals and risk tolerance.

Stocks: Generally, stocks offer higher returns but come with higher volatility. They should constitute a significant portion of your portfolio if you have a high-risk tolerance and a long-term horizon.

Bonds: Bonds are less volatile than stocks and provide regular interest income. They are suitable for conservative investors or those nearing their financial goals.

Real Estate: Real estate can offer income through rents and potential appreciation. Real Estate Investment Trusts (REITs) are a way to invest in real estate without owning physical property.

Commodities: Commodities like gold, silver, and oil can hedge against inflation. They are more volatile but can provide diversification benefits.

Cash and Cash Equivalents: These include savings accounts, certificates of deposit (CDs), and money market funds. They provide liquidity and stability but offer lower returns.

Choose Your Investments

Once you’ve determined your asset allocation, the next step is to choose specific investments within each asset class. Consider the following:

Individual Stocks: Research and select stocks from various sectors. Look for companies with strong financials, competitive advantages, and growth potential.

Mutual Funds and ETFs: These funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. They offer instant diversification and professional management.

Bonds: Choose a mix of government, municipal, and corporate bonds with varying maturities. Consider bond funds or ETFs for broader exposure.

REITs: Invest in REITs to gain exposure to real estate without owning physical property. Look for REITs that invest in different types of properties (residential, commercial, industrial).

Commodities: Consider investing in commodity ETFs or mutual funds that track the price of specific commodities.

Implement Geographic Diversification

Including international investments can further diversify your portfolio and reduce country-specific risks. Look for opportunities in both developed and emerging markets.

Developed Markets: These include the US, Europe, Japan, and other stable economies. They offer lower risk but potentially lower returns compared to emerging markets.

Emerging Markets: Countries like China, India, and Brazil offer higher growth potential but come with higher risk. Emerging market funds can provide exposure to these regions.

Regularly Rebalance Your Portfolio

Rebalancing involves adjusting your portfolio periodically to maintain your desired asset allocation. Over time, some investments may grow faster than others, skewing your allocation.

Set a Rebalancing Schedule: Decide whether to rebalance quarterly, semi-annually, or annually. Stick to this schedule to maintain discipline.

Rebalance Based on Thresholds: Alternatively, rebalance when an asset class deviates from your target allocation by a certain percentage (e.g., 5%).

Consider Tax Implications

Tax efficiency is an important aspect of portfolio management. Different investments have varying tax treatments, and managing these can enhance your after-tax returns.

Tax-Advantaged Accounts: Utilize accounts like IRAs, 401(k)s, and Roth IRAs, which offer tax deferral or tax-free growth.

Tax-Efficient Investments: Consider municipal bonds, which are generally exempt from federal taxes, and index funds or ETFs, which tend to generate fewer taxable events.

Tax-Loss Harvesting: Sell losing investments to offset gains in other areas, thereby reducing your taxable income.

Stay Informed and Adaptable

The investment landscape is dynamic, and staying informed about market trends, economic indicators, and geopolitical events is crucial for maintaining a diversified portfolio.

Regular Research: Keep up with financial news, market analysis, and economic reports to understand the broader context of your investments.

Flexibility: Be prepared to adjust your strategy as your financial situation or market conditions change. Flexibility is key to long-term investment success.

Diversification Strategies for Different Types of Investors

Conservative Investors

Conservative investors prioritize capital preservation and income generation. Their portfolios typically have a higher allocation to bonds and cash equivalents, with a smaller portion in stocks and real estate.

Bond Laddering: This strategy involves purchasing bonds with different maturities to spread out interest rate risk.

Dividend-Paying Stocks: Focus on blue-chip companies with a history of paying and increasing dividends, providing a steady income stream.

Moderate Investors

Moderate investors seek a balance between growth and stability. Their portfolios often include a mix of stocks, bonds, and alternative investments like real estate.

Balanced Funds: These funds automatically allocate assets between stocks and bonds, providing a diversified portfolio with moderate risk.

Sector Diversification: Invest in multiple sectors to spread risk and capitalize on growth opportunities across different industries.

Aggressive Investors

Aggressive investors are willing to take on higher risk for the potential of higher returns. Their portfolios are heavily weighted towards stocks, particularly growth stocks and emerging markets.

Growth Stocks: Focus on companies with strong earnings growth potential, even if they are more volatile.

International Exposure: Allocate a significant portion to emerging markets, which offer higher growth potential but also higher risk.

Advanced Diversification Techniques

Alternative Investments

Beyond traditional asset classes, alternative investments can provide additional diversification and potential for higher returns.

Private Equity: Investing in private companies can offer substantial returns, but it requires a long-term commitment and higher risk tolerance.

Hedge Funds: These funds use complex strategies to achieve returns independent of market movements. They can be risky and are typically accessible only to accredited investors.

Commodities and Futures: Investing in commodities and futures contracts can hedge against inflation and provide diversification, but they are complex and require careful management.

Thematic Investing

Thematic investing focuses on long-term trends and themes rather than specific sectors or asset classes. Examples include:

Technology Innovation: Investing in companies driving technological advancements, such as AI, blockchain, and renewable energy.

Demographic Shifts: Targeting investments that benefit from demographic trends like aging populations or urbanization.

Environmental Sustainability: Focusing on companies leading in environmental stewardship and sustainable practices.

Tools and Resources for Building a Diversified Portfolio

Financial Advisors

A certified financial advisor can provide personalized advice, helping you create a diversified portfolio tailored to your goals and risk tolerance.

Online Platforms

Robo-advisors and online brokerage platforms offer tools and automated services to build and manage a diversified portfolio at a low cost.

Educational Resources

Books, courses, and online resources can enhance your understanding of diversification strategies and investment principles.

Building a diversified portfolio is essential for managing risk and achieving long-term financial success. By spreading your investments across various asset classes, sectors, and geographic regions, you can protect against market volatility and enhance your potential for returns. Whether you are a conservative, moderate, or aggressive investor, understanding and implementing diversification strategies will help you build a robust and resilient portfolio. Stay informed, regularly review and rebalance your portfolio, and adapt your strategy as needed to stay on track with your financial goals.