The financial landscape has witnessed a significant transformation with the advent of cryptocurrencies, presenting a modern, digital alternative to traditional investments. This shift has sparked a debate among investors: should one invest in cryptocurrencies or stick to conventional investment avenues like stocks, bonds, and real estate? This comprehensive article delves into the key aspects of both investment types, comparing their benefits, risks, and potential returns to help investors make informed decisions.

Contents

- 1 Understanding Cryptocurrency and Traditional Investments

- 2 Benefits of Cryptocurrency

- 2.1 High Potential Returns

- 2.2 Decentralization and Transparency

- 2.3 Accessibility and Inclusivity

- 2.4 Diversification Benefits

- 2.5 Innovation and Technological Advancement

- 2.6 Risks of Cryptocurrency

- 2.7 Volatility

- 2.8 Regulatory Uncertainty

- 2.9 Security Concerns

- 2.10 Lack of Tangibility

- 2.11 Market Manipulation

- 3 Benefits of Traditional Investments

- 4 Risks of Traditional Investments

- 5 Comparative Analysis

- 6 Liquidity

- 7 Regulatory Environment

- 8 Accessibility and Inclusivity

- 9 Innovation and Growth Potential

- 10 Case Studies

- 11 Making an Informed Decision

Understanding Cryptocurrency and Traditional Investments

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. The most well-known cryptocurrency is Bitcoin, but thousands of other cryptocurrencies exist, including Ethereum, Ripple, and Litecoin.

What are Traditional Investments?

Traditional investments refer to conventional financial assets like stocks, bonds, mutual funds, and real estate. These investments have been the backbone of investment portfolios for decades, offering various levels of risk and return to suit different investor preferences.

Benefits of Cryptocurrency

High Potential Returns

Cryptocurrencies have demonstrated the potential for extraordinary returns. For example, Bitcoin, the first and most well-known cryptocurrency, has seen its value skyrocket from a few cents to tens of thousands of dollars over the past decade. Early adopters of cryptocurrencies have often enjoyed substantial gains.

Decentralization and Transparency

Cryptocurrencies operate on decentralized networks, typically using blockchain technology. This decentralization means that no single entity controls the currency, reducing the risk of manipulation. Additionally, blockchain’s transparent nature allows all transactions to be publicly recorded and verified, enhancing security and trust.

Accessibility and Inclusivity

Cryptocurrencies can be accessed and traded globally, providing financial inclusion to people who might not have access to traditional banking services. All that is needed is an internet connection and a digital wallet.

Diversification Benefits

Including cryptocurrencies in an investment portfolio can offer diversification benefits. Cryptocurrencies often have low correlations with traditional asset classes, meaning their price movements may not be closely tied to those of stocks or bonds. This can help reduce overall portfolio risk.

Innovation and Technological Advancement

Investing in cryptocurrencies is also an investment in the underlying blockchain technology, which has far-reaching applications beyond just digital currencies. Blockchain technology is being explored for use in various sectors, including finance, supply chain management, healthcare, and more.

Risks of Cryptocurrency

Volatility

Cryptocurrencies are known for their extreme volatility. Prices can fluctuate wildly within short periods, leading to substantial gains or losses. This volatility can be unsettling for investors who prefer stable returns.

Regulatory Uncertainty

The regulatory environment for cryptocurrencies is still evolving. Governments and regulatory bodies worldwide are grappling with how to classify and regulate cryptocurrencies, leading to uncertainty that can impact their value and usability.

Security Concerns

While blockchain technology is inherently secure, the platforms and exchanges where cryptocurrencies are traded can be vulnerable to hacking and fraud. There have been numerous instances of cryptocurrency exchanges being hacked, resulting in significant losses for investors.

Lack of Tangibility

Cryptocurrencies are purely digital and do not have any physical form. This lack of tangibility can be a drawback for some investors who prefer tangible assets like real estate or commodities.

Market Manipulation

The relatively small size and nascent state of the cryptocurrency market make it susceptible to manipulation by large investors or “whales.” These players can significantly influence prices by making large trades.

Benefits of Traditional Investments

Established Track Record

Traditional investments like stocks, bonds, and real estate have been around for centuries and have a proven track record of delivering returns. Historical data can provide insights into their performance, helping investors make informed decisions.

Regulatory Oversight

Traditional investments are subject to regulatory oversight by government bodies and financial institutions. This oversight helps protect investors from fraud and ensures transparency and fairness in the markets.

Income Generation

Many traditional investments can generate regular income. For example, stocks may pay dividends, bonds offer interest payments, and real estate can provide rental income. This income can be a valuable source of cash flow for investors.

Tangibility

Some traditional investments, like real estate and commodities, are tangible assets. This tangibility can provide a sense of security and ownership that purely digital assets like cryptocurrencies may lack.

Lower Volatility

While traditional investments are not without risk, they tend to be less volatile than cryptocurrencies. This lower volatility can provide a more stable investment experience, which may be preferable for risk-averse investors.

Risks of Traditional Investments

Market Risk

Traditional investments are subject to market risk, meaning their value can fluctuate based on economic conditions, investor sentiment, and other factors. For example, stock prices can be influenced by corporate earnings, economic data, and geopolitical events.

Inflation Risk

Inflation can erode the purchasing power of money over time, impacting the real returns of traditional investments. For instance, the fixed interest payments from bonds may not keep pace with rising inflation, reducing their value in real terms.

Interest Rate Risk

Changes in interest rates can affect the value of traditional investments, particularly bonds. When interest rates rise, the prices of existing bonds typically fall, and vice versa. This interest rate risk can impact bond investors’ returns.

Liquidity Risk

Some traditional investments, like real estate, can be relatively illiquid, meaning they cannot be quickly sold or converted into cash without potentially impacting their price. This liquidity risk can be a concern for investors who may need to access their funds on short notice.

Management and Operational Risks

Investments in companies, whether through stocks or bonds, are subject to management and operational risks. Poor management decisions, operational failures, or changes in market conditions can negatively impact the performance and value of these investments.

Comparative Analysis

Risk-Return Profile

Cryptocurrencies

Cryptocurrencies have a high-risk, high-reward profile. Their prices can experience rapid and significant fluctuations, offering the potential for substantial gains but also posing the risk of significant losses. This high volatility can be both an opportunity and a challenge for investors.

Traditional Investments

Traditional investments generally offer a more balanced risk-return profile. While they can still be volatile, their price movements tend to be less extreme compared to cryptocurrencies. Stocks, for example, can provide substantial returns over the long term, while bonds offer more stable, albeit lower, returns.

Liquidity

Cryptocurrencies

Cryptocurrencies are highly liquid, as they can be traded 24/7 on various exchanges worldwide. This liquidity allows investors to quickly buy or sell their holdings at any time, providing flexibility and ease of access.

Traditional Investments

Liquidity varies among traditional investments. Stocks and bonds traded on major exchanges are generally highly liquid, allowing for quick transactions. However, assets like real estate and certain types of bonds can be less liquid, requiring more time to buy or sell.

Regulatory Environment

Cryptocurrencies

The regulatory environment for cryptocurrencies is still evolving and can vary significantly between countries. This lack of uniform regulation can create uncertainty and risk for investors. However, it also presents opportunities for regulatory arbitrage and innovation.

Traditional Investments

Traditional investments are subject to well-established regulatory frameworks designed to protect investors and ensure market integrity. This regulatory oversight provides a level of security and confidence for investors but can also result in higher compliance costs and reduced flexibility.

Accessibility and Inclusivity

Cryptocurrencies

Cryptocurrencies are accessible to anyone with an internet connection and a digital wallet. This accessibility democratizes investment opportunities, allowing people worldwide to participate in the market without needing a traditional brokerage account.

Traditional Investments

Access to traditional investments often requires a brokerage account, financial advisor, or access to financial markets. While these barriers are lower than in the past, they can still limit participation for some investors, particularly those in developing regions.

Innovation and Growth Potential

Cryptocurrencies

Cryptocurrencies represent a cutting-edge technology with significant growth potential. The underlying blockchain technology is being explored for various applications beyond just digital currency, including smart contracts, supply chain management, and decentralized finance (DeFi).

Traditional Investments

Traditional investments are tied to established industries and markets. While these markets can still offer growth potential, particularly in emerging sectors like technology and renewable energy, they may not match the rapid innovation seen in the cryptocurrency space.

Case Studies

Case Study 1: Bitcoin vs. S&P 500

Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has delivered remarkable returns since its inception in 2009. Early adopters who held their Bitcoin through its various price cycles have seen substantial gains. However, Bitcoin’s price has also experienced significant volatility, with multiple instances of sharp declines.

S&P 500

The S&P 500, a stock market index that includes 500 of the largest U.S. companies, has been a reliable indicator of the performance of the U.S. stock market. Over the long term, the S&P 500 has delivered steady returns, averaging around 7-10% annually. While it has experienced periods of volatility, such as during the 2008 financial crisis and the COVID-19 pandemic, it has generally recovered and continued to grow.

Case Study 2: Ethereum vs. Real Estate

Ethereum

Ethereum is a leading cryptocurrency known for its smart contract functionality. Since its launch in 2015, Ethereum has seen significant price appreciation, driven by its innovative technology and growing adoption. However, like other cryptocurrencies, Ethereum’s price has been highly volatile.

Real Estate

Real estate has long been considered a stable and tangible investment. Property values can appreciate over time, and real estate can generate rental income, providing both capital appreciation and cash flow. While real estate can be affected by economic cycles, it is generally considered less volatile than cryptocurrencies.

Making an Informed Decision

Risk Tolerance

Investors must assess their risk tolerance when choosing between cryptocurrencies and traditional investments. Those with a high risk tolerance and a willingness to endure significant price volatility may find cryptocurrencies appealing. Conversely, risk-averse investors may prefer the stability and predictability of traditional investments.

Investment Goals

Investment goals play a crucial role in determining the appropriate asset allocation. Short-term investors seeking quick gains may be drawn to the potential of cryptocurrencies, while long-term investors focused on steady growth and income generation may prefer traditional investments.

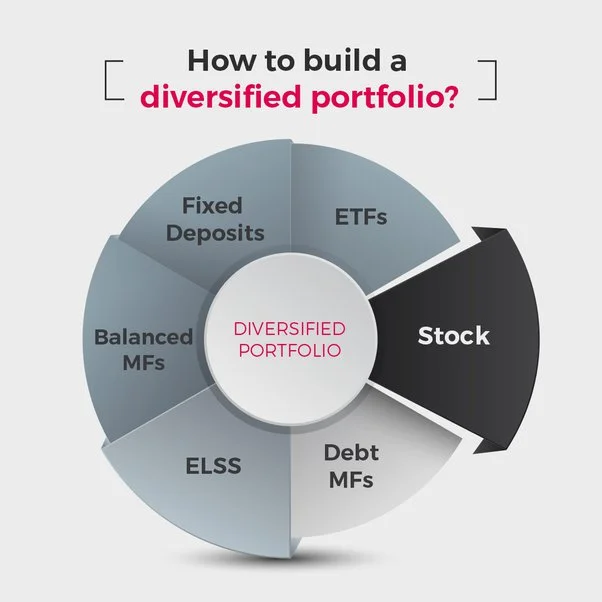

Diversification

Diversification is a fundamental principle of investing that involves spreading investments across different asset classes to reduce risk. A diversified portfolio that includes both cryptocurrencies and traditional investments can help balance the potential for high returns with the need for stability.

Research and Due Diligence

Thorough research and due diligence are essential when investing in any asset class. Investors should understand the fundamentals, risks, and potential rewards of both cryptocurrencies and traditional investments before making decisions. Staying informed about market trends, regulatory developments, and technological advancements can help investors navigate the evolving financial landscape.

The debate between cryptocurrency and traditional investments ultimately boils down to individual preferences, risk tolerance, and investment goals. Cryptocurrencies offer the allure of high potential returns, decentralization, and innovation but come with significant risks, including volatility, regulatory uncertainty, and security concerns. Traditional investments provide a proven track record, regulatory oversight, income generation, and lower volatility but may lack the explosive growth potential of cryptocurrencies.

A balanced approach that incorporates both asset classes can provide the benefits of diversification, allowing investors to capitalize on the strengths of each while mitigating their respective risks. By carefully assessing their financial goals, risk tolerance, and market conditions, investors can make informed decisions and build a robust and resilient investment portfolio.

Ultimately, there is no one-size-fits-all answer to whether cryptocurrencies or traditional investments are better. Each investor’s circumstances and preferences will dictate the most suitable strategy, and a thoughtful, well-researched approach will help ensure long-term success in the dynamic world of investing.