Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies on the foreign exchange market with the aim of making a profit. It is one of the largest and most liquid financial markets globally, with trillions of dollars traded daily. This comprehensive guide explores the fundamentals of forex trading, including its mechanics, participants, strategies, risks, and key factors that influence currency prices.

Contents

Introduction to Forex Trading

What is Forex Trading?

Forex trading involves the exchange of currencies in pairs, such as EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). The primary objective is to profit from changes in exchange rates between currencies over time. Traders speculate on whether a currency will strengthen or weaken relative to another, aiming to buy low and sell high or sell high and buy low.

Key Participants in the Forex Market

1. Commercial Banks:

Commercial banks facilitate forex transactions for clients, including corporations, governments, and individual traders. They act as market makers, providing liquidity by quoting bid and ask prices for currency pairs.

2. Central Banks:

Central banks play a crucial role in the forex market by implementing monetary policies that influence exchange rates. They may intervene in the market to stabilize their country’s currency or achieve economic objectives.

3. Investment Firms and Hedge Funds:

Investment firms and hedge funds engage in forex trading to capitalize on currency movements. They often use sophisticated strategies and trade large volumes, impacting market liquidity and price fluctuations.

4. Retail Traders:

Individual traders participate in the forex market through online platforms offered by brokers. Retail traders can access leverage, allowing them to control larger positions with a smaller initial investment.

Mechanics of Forex Trading

Currency Pairs

Forex trading involves trading currency pairs, where one currency is exchanged for another. Each currency pair is quoted with a bid (selling) price and an ask (buying) price. The exchange rate represents the amount of the quote currency required to buy one unit of the base currency.

Major Currency Pairs

Major currency pairs are the most traded pairs in the forex market and include:

EUR/USD: Euro/US Dollar

USD/JPY: US Dollar/Japanese Yen

GBP/USD: British Pound/US Dollar

USD/CHF: US Dollar/Swiss Franc

AUD/USD: Australian Dollar/US Dollar

USD/CAD: US Dollar/Canadian Dollar

Cross Currency Pairs

Cross currency pairs do not involve the US Dollar and include combinations of other major currencies, such as EUR/GBP (Euro/British Pound) or AUD/JPY (Australian Dollar/Japanese Yen).

Exchange Rate Movements

Exchange rates fluctuate based on various factors, including economic data releases, geopolitical events, interest rate decisions, and market sentiment. Traders analyze these factors to anticipate currency movements and make informed trading decisions.

Fundamental Concepts in Forex Trading

1. Pips and Spreads:

Pip: A pip is the smallest price move that a given exchange rate can make. Most currency pairs are quoted to four decimal places, with one pip representing 0.0001.

Spread: The spread is the difference between the bid and ask prices of a currency pair. It represents the cost of trading and can vary depending on market liquidity and volatility.

2. Leverage and Margin:

Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. It amplifies both potential profits and losses.

Margin: Margin is the amount of money required to open and maintain a leveraged position. It acts as a collateral against potential losses.

3. Order Types:

Market Order: A market order is executed immediately at the current market price.

Limit Order: A limit order is placed to buy below or sell above the current market price, specifying a target price.

Stop Order: A stop order becomes a market order once a specified price level is reached, helping to limit losses or lock in profits.

Fundamental Analysis in Forex Trading

Economic Indicators

Forex traders analyze economic indicators to assess the strength of economies and predict currency movements:

Gross Domestic Product (GDP): Measures the economic output of a country.

Employment Reports: Including Non-Farm Payrolls (NFP) in the United States, indicating job creation and unemployment rates.

Inflation Data: Such as Consumer Price Index (CPI) and Producer Price Index (PPI), reflecting changes in price levels.

Central Bank Policies

Central banks’ decisions on interest rates and monetary policies have a significant impact on currency valuations:

Interest Rate Decisions: Higher interest rates typically strengthen a currency as they attract foreign capital.

Quantitative Easing (QE): Central bank asset purchases to stimulate the economy can weaken a currency.

Geopolitical Events

Political instability, trade tensions, and geopolitical developments can create volatility in currency markets:

Brexit: The United Kingdom’s decision to leave the European Union affected the value of the British Pound.

Trade Negotiations: Tariffs and trade agreements influence currency values, especially for export-driven economies.

Technical Analysis in Forex Trading

Chart Patterns

Technical analysts use chart patterns to identify trends and potential entry or exit points:

Support and Resistance Levels: Price levels where buying or selling pressure is expected to occur.

Trendlines: Lines drawn to connect consecutive highs or lows, indicating the direction of the trend.

Chart Patterns: Such as head and shoulders, double tops or bottoms, and triangles, signaling potential reversals or continuations.

Indicators and Oscillators

Technical indicators and oscillators help traders gauge market momentum and potential price reversals:

Moving Averages: Smoothed averages of past price data, highlighting trends.

Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Compares moving averages to detect changes in trend momentum.

Risk Management in Forex Trading

Importance of Risk Management

Risk management is crucial to protect capital and minimize losses in forex trading:

Position Sizing: Determining the size of each trade based on risk tolerance and account size.

Stop-Loss Orders: Setting predefined exit points to limit potential losses.

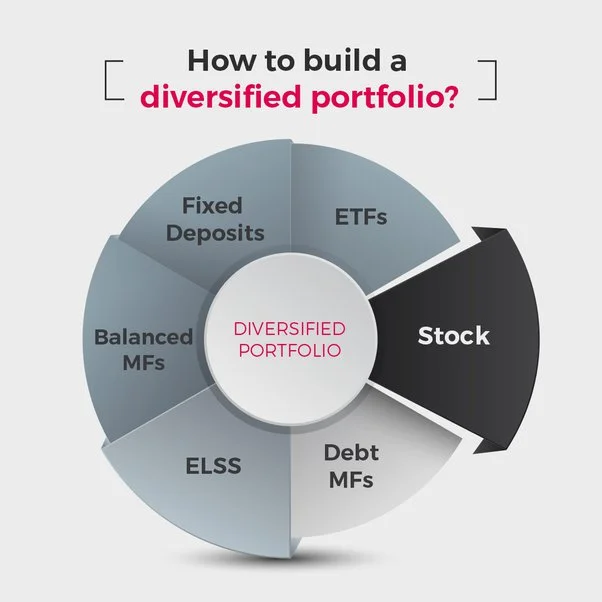

Diversification: Spreading risk across multiple currency pairs and asset classes.

Psychological Factors

Emotional discipline and psychological resilience are essential for successful forex trading:

Patience and Discipline: Following a trading plan and avoiding impulsive decisions.

Risk Aversion and Overconfidence: Balancing caution with confidence to maintain consistent trading performance.

Choosing a Forex Broker

Considerations When Selecting a Broker

Choosing a reputable and reliable forex broker is essential for a positive trading experience:

Regulation: Ensure the broker is regulated by a recognized financial authority to protect funds and ensure fair trading practices.

Trading Platform: Evaluate the broker’s trading platform for reliability, user-friendly interface, and access to essential tools and resources.

Customer Support: Reliable customer support is crucial for resolving issues and receiving assistance during trading hours.

Strategies for Forex Trading

Common Trading Strategies

Various trading strategies can be employed in forex trading, depending on market conditions and trader preferences:

Day Trading: Opening and closing positions within the same trading day to capitalize on intraday price movements.

Swing Trading: Holding positions for several days to weeks based on medium-term price trends.

Position Trading: Taking long-term positions based on fundamental analysis and broader market trends.

Carry Trade

The carry trade strategy involves borrowing funds in a low-interest-rate currency and investing in a higher-yielding currency to capture interest rate differentials:

Interest Rate Differential: Profit is earned from the interest rate spread between the two currencies.

Currency Risk: Exchange rate fluctuations can impact profitability, requiring careful risk management.

Challenges and Risks of Forex Trading

Volatility and Leverage

Forex markets are highly volatile, amplifying potential gains and losses, especially when using leverage:

Leverage Risk: Excessive leverage can lead to significant losses exceeding initial investments.

Market Volatility: Sudden price movements can trigger stop-loss orders or margin calls.

Broker Risks

Choosing an unreliable or unregulated broker can expose traders to financial losses and operational risks:

Counterparty Risk: The risk that the broker may default on obligations or fail to execute trades.

Trading Conditions: Poor execution, slippage, and requotes can affect trading outcomes.

Psychological Challenges

Emotional biases and psychological pressures can impair decision-making and trading performance:

Fear and Greed: Emotional responses to market fluctuations can lead to impulsive trading decisions.

Overtrading: Excessive trading driven by emotional responses rather than a disciplined strategy.

Future Trends in Forex Trading

Technological Advancements

Advances in technology, including artificial intelligence (AI) and algorithmic trading, are reshaping forex trading:

AI and Machine Learning: Automated trading systems analyze vast amounts of data to execute trades based on predefined algorithms.

High-Frequency Trading (HFT): Algorithms execute trades at high speeds to capitalize on fleeting market opportunities.

Regulatory Developments

Regulatory frameworks are evolving to address technological advancements and protect investors:

Transparency: Regulatory authorities are enhancing transparency and oversight of forex markets to prevent fraud and ensure fair trading practices.

Crypto Regulation: Regulations governing cryptocurrencies and digital assets impact forex trading and market dynamics.

Forex trading offers opportunities for individuals and institutions to participate in the global currency market and potentially profit from currency fluctuations. Understanding the basics of forex trading, including currency pairs, market mechanics, trading strategies, and risk management, is essential for successful trading outcomes. Whether you are a beginner or experienced trader, developing a solid foundation in forex fundamentals and adopting disciplined trading practices can help navigate the complexities of the forex market and achieve your financial goals.

By staying informed about economic indicators, geopolitical events, and market trends, traders can make informed decisions and adapt their strategies to changing market conditions. Continuous learning, practice, and adherence to risk management principles are key to long-term success in forex trading. As with any form of investment, careful planning, patience, and discipline are crucial for achieving sustainable profitability and managing risks effectively in the dynamic world of forex trading.