Understanding how interest rates impact your investments is crucial for making informed financial decisions. Interest rates, determined by central banks, influence the economy, affecting everything from borrowing costs to stock market performance. This comprehensive guide explores the multifaceted relationship between interest rates and investments, providing insights into how various assets react to rate changes and strategies to navigate these fluctuations.

Contents

- 1 1. Understanding Interest Rates

- 2 5. Interest Rates and Alternative Investments

- 3 6. Global Interest Rate Dynamics

- 4 7. Strategies to Navigate Interest Rate Changes

- 5 8. Case Studies: Historical Impact of Interest Rates on Investments

1. Understanding Interest Rates

Interest rates are the cost of borrowing money, expressed as a percentage of the loan amount. Central banks, such as the Federal Reserve in the United States, set short-term interest rates to control monetary policy. These rates influence economic activity by affecting consumer spending, business investment, and inflation.

1.1 Types of Interest Rates

Nominal Interest Rate: The stated rate on a loan or investment without adjusting for inflation.

Real Interest Rate: The nominal rate adjusted for inflation, representing the true cost of borrowing.

Effective Interest Rate: The rate that considers compounding periods within a year.

2. Interest Rates and Bonds

Bonds are fixed-income securities that are particularly sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. This inverse relationship is due to the fixed interest payments that bonds provide, which become less attractive when new bonds offer higher rates.

2.1 Bond Prices and Yields

Price-Yield Relationship: As interest rates increase, the yield on existing bonds must increase to compete with new bonds, resulting in a decrease in their prices. Duration and Sensitivity: The longer a bond’s duration, the more sensitive it is to interest rate changes. Long-term bonds experience greater price fluctuations than short-term bonds.

2.2 Types of Bonds

Government Bonds: Issued by national governments, these are generally considered low-risk. Interest rate changes impact their prices significantly due to their longer durations.

Corporate Bonds: Issued by companies, these bonds offer higher yields but carry more risk. Interest rate changes affect corporate bonds based on the issuer’s creditworthiness and bond maturity.

Municipal Bonds: Issued by local governments, these bonds are often tax-exempt and react similarly to government bonds in response to interest rate changes.

3. Interest Rates and Equities

Interest rates also impact the stock market, albeit differently than bonds. The relationship is more complex and influenced by various factors, including company performance, economic conditions, and investor sentiment.

3.1 Valuation and Discounted Cash Flow

Discount Rate: Interest rates affect the discount rate used in discounted cash flow (DCF) analysis, a method to value stocks. Higher rates increase the discount rate, reducing the present value of future cash flows and potentially lowering stock prices.

Earnings Impact: Higher interest rates can lead to increased borrowing costs for companies, reducing profitability. Conversely, lower rates can boost earnings by lowering interest expenses.

3.2 Sector Sensitivity

Interest-Sensitive Sectors: Utilities, real estate, and consumer staples are typically more sensitive to interest rate changes due to their reliance on debt and stable, but slow-growing, income streams.

Growth vs. Value Stocks: Growth stocks, which rely heavily on future earnings potential, are more adversely affected by rising interest rates compared to value stocks, which have more stable earnings and dividends.

4. Interest Rates and Real Estate

Real estate investments are significantly impacted by interest rate changes. Mortgage rates, influenced by central bank rates, determine the cost of borrowing for homebuyers and investors.

4.1 Residential Real Estate

Mortgage Rates: Higher interest rates increase mortgage rates, making home loans more expensive. This can reduce demand for housing, leading to lower home prices.

Affordability: Rising rates can reduce affordability for potential buyers, potentially slowing down the housing market.

4.2 Commercial Real Estate

Capital Costs: Commercial real estate investments often rely on financing. Higher interest rates increase borrowing costs, affecting the profitability of these investments.

Cap Rates: The capitalization rate (cap rate), used to value commercial properties, tends to rise with interest rates, leading to lower property values.

5. Interest Rates and Alternative Investments

Alternative investments, such as commodities, hedge funds, and private equity, also respond to interest rate changes, although the impact varies widely depending on the asset.

5.1 Commodities

Gold and Precious Metals: Often seen as a hedge against inflation, gold prices can be influenced by interest rates. Lower rates can boost gold prices as the opportunity cost of holding non-yielding assets decreases.

Oil and Natural Resources: Interest rates can impact global economic activity, influencing demand for oil and other resources. Higher rates can lead to lower demand and prices.

5.2 Hedge Funds and Private Equity

Leverage: Many hedge funds and private equity firms use leverage to enhance returns. Higher interest rates increase the cost of borrowing, potentially reducing profitability.

Investment Horizon: Long-term investments, typical in private equity, are more sensitive to interest rate changes, impacting the valuation and exit strategies.

6. Global Interest Rate Dynamics

Interest rates are not uniform across the globe, and changes in one country can impact investments in another. Understanding global interest rate dynamics is crucial for international investors.

6.1 Currency Exchange Rates

Carry Trade: Investors borrow in low-interest-rate currencies to invest in high-interest-rate currencies. Changes in global rates can impact the profitability of these trades.

Currency Valuation: Interest rate differentials between countries can affect exchange rates. Higher rates in one country can attract foreign capital, strengthening the currency.

6.2 Emerging Markets

Capital Flows: Higher interest rates in developed markets can lead to capital outflows from emerging markets, impacting their economic stability and investment returns.

Debt Servicing: Emerging markets often have significant foreign-denominated debt. Higher global rates can increase debt servicing costs, affecting economic growth and investment performance.

Investors can adopt various strategies to manage the impact of interest rate changes on their portfolios.

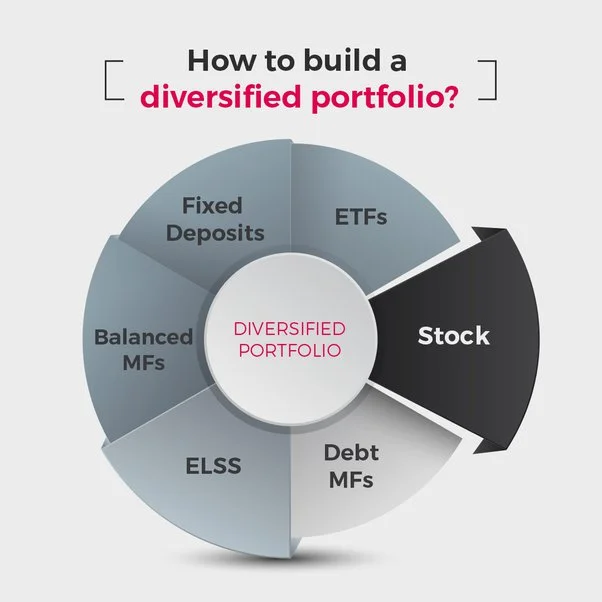

7.1 Diversification

Asset Allocation: Diversifying across asset classes can help mitigate the impact of interest rate changes. A mix of stocks, bonds, real estate, and alternative investments can provide balance.

Geographical Diversification: Investing in different regions can reduce the impact of interest rate changes in any single country.

7.2 Duration Management

Bond Laddering: Building a bond ladder, with bonds maturing at different intervals, can reduce interest rate risk and provide steady income.

Floating Rate Bonds: Consider investing in floating rate bonds, which adjust interest payments based on market rates, providing protection against rising rates.

7.3 Active Management

Tactical Asset Allocation: Active management allows for adjusting the portfolio based on interest rate expectations. Shifting assets to sectors or regions expected to perform better can enhance returns.

Hedging: Using financial instruments like futures, options, and interest rate swaps can hedge against adverse interest rate movements.

8. Case Studies: Historical Impact of Interest Rates on Investments

Examining historical events provides valuable insights into how interest rates have impacted investments in the past.

8.1 The Great Recession (2007-2009)

Interest Rate Cuts: In response to the financial crisis, central banks worldwide slashed interest rates to stimulate the economy. This led to a significant rally in both bond and equity markets as borrowing costs decreased.

Real Estate Impact: Lower interest rates made mortgages more affordable, helping to stabilize and eventually boost the real estate market.

8.2 The Dot-Com Bubble (1999-2000)

Rate Increases: Prior to the bubble burst, the Federal Reserve raised interest rates to curb inflation. Higher rates contributed to the market correction as borrowing costs rose and speculative investments became less attractive.

Sector Rotation: The tech sector, heavily reliant on growth projections, was hit hard by rising rates, while more stable sectors like consumer staples fared better.

Interest rates play a pivotal role in shaping investment outcomes. Understanding the intricate relationship between rates and various asset classes enables investors to make informed decisions and develop strategies to navigate rate changes. By diversifying investments, managing duration, and adopting active management strategies, investors can mitigate risks and capitalize on opportunities in different interest rate environments.

Staying informed about global economic conditions and central bank policies is essential for anticipating interest rate movements. With a comprehensive understanding of how interest rates impact investments, investors can better position themselves for long-term financial success.