Emerging markets have long been considered the frontier of high growth potential for investors seeking to diversify their portfolios and tap into new sources of returns. With the increasing globalization of economies and financial markets, emerging markets have become an attractive destination for both institutional and individual investors. However, these markets come with their own set of risks and challenges. This article explores the opportunities and risks associated with investing in emerging markets, providing insights and strategies for navigating this dynamic landscape.

Contents

Understanding Emerging Markets

Definition and Characteristics

Emerging markets refer to economies that are in the process of rapid growth and industrialization. These markets are typically characterized by:

Economic Growth: Higher GDP growth rates compared to developed markets.

Market Maturity: Developing financial markets that are less mature but growing.

Demographic Trends: Young and growing populations that contribute to labor force expansion and consumer market growth.

Infrastructure Development: Ongoing improvements in infrastructure, such as transportation, communication, and energy.

Political and Economic Reform: Efforts to implement reforms that promote economic stability, transparency, and foreign investment.

Examples of Emerging Markets

Some prominent emerging markets include:

China: The world’s second-largest economy, known for its rapid industrialization and urbanization.

India: A large, diverse economy with a burgeoning middle class and strong tech sector.

Brazil: Rich in natural resources, with significant agricultural and mining industries.

Russia: An energy powerhouse with vast oil and gas reserves.

South Africa: The most developed economy in Africa, with a strong mining sector.

Indonesia: The largest economy in Southeast Asia, with a young population and growing middle class.

Mexico: A major manufacturing hub with close ties to the United States.

Opportunities in Emerging Markets

High Growth Potential

One of the primary attractions of emerging markets is their high growth potential. These economies often experience faster GDP growth rates than developed markets due to:

Rapid Industrialization: Transition from agrarian to industrial economies leads to increased productivity and economic output.

Urbanization: Migration of populations from rural to urban areas boosts demand for housing, infrastructure, and services.

Rising Middle Class: Growth of the middle class increases consumer spending on goods and services.

Technological Adoption: Leapfrogging technologies enable rapid advancement in sectors such as telecommunications, banking, and healthcare.

Diversification Benefits

Investing in emerging markets can provide significant diversification benefits to a portfolio. These markets often have low correlations with developed markets, meaning their performance may not move in tandem with traditional assets like U.S. or European equities. This diversification can help reduce overall portfolio risk and enhance returns.

Undervalued Assets

Emerging markets can offer opportunities to invest in undervalued assets. Due to factors such as lower market efficiency, limited analyst coverage, and investor skepticism, many companies in these markets may be trading at lower valuations relative to their growth prospects. Savvy investors can identify and capitalize on these opportunities through thorough research and analysis.

Exposure to Natural Resources

Many emerging markets are rich in natural resources such as oil, gas, minerals, and agricultural products. Investing in these markets can provide exposure to commodities and sectors that benefit from global demand for raw materials. As economies develop and industrialize, the value of these resources and related industries can increase significantly.

Favorable Demographics

Emerging markets often have favorable demographic trends, such as young and growing populations. This demographic advantage can lead to a larger labor force, increased consumer spending, and higher economic growth. Investing in companies that cater to the needs and preferences of these populations can yield substantial returns.

Government Reforms

Many emerging markets are undergoing political and economic reforms aimed at improving business environments, reducing corruption, and attracting foreign investment. These reforms can create a more stable and predictable investment climate, fostering long-term growth and profitability.

Risks of Investing in Emerging Markets

Political and Economic Instability

Political and economic instability is one of the most significant risks associated with emerging markets. Factors contributing to this instability include:

Political Uncertainty: Changes in government, policy shifts, and political unrest can disrupt economic activities and affect investor confidence.

Economic Volatility: Emerging markets may experience higher levels of inflation, currency fluctuations, and fiscal imbalances.

Regulatory Risks: Lack of regulatory transparency and unpredictable changes in laws and regulations can create an uncertain business environment.

Currency Risk

Investing in emerging markets exposes investors to currency risk, which arises from fluctuations in exchange rates. Currency devaluations can erode the value of investments and returns. Factors contributing to currency risk include:

Monetary Policy: Central bank actions, such as interest rate changes and currency interventions, can impact exchange rates.

Trade Balances: Countries with large trade deficits may experience downward pressure on their currencies.

Capital Flows: Sudden shifts in capital flows, such as large-scale foreign investment inflows or outflows, can cause currency volatility.

Market Liquidity

Emerging markets often have lower market liquidity compared to developed markets. This means that buying and selling securities can be more challenging, especially during periods of market stress. Low liquidity can result in:

Higher Transaction Costs: Larger bid-ask spreads and higher trading commissions.

Price Volatility: Greater price swings due to limited trading volumes.

Difficulty Exiting Positions: Challenges in quickly selling investments without significantly impacting market prices.

Corporate Governance and Transparency

Corporate governance standards and transparency levels in emerging markets can be lower than in developed markets. This can lead to:

Accounting Irregularities: Inconsistent or misleading financial reporting.

Insider Trading and Fraud: Higher risks of unethical behavior and market manipulation.

Lack of Shareholder Protections: Weak legal frameworks to protect minority shareholders’ rights.

Geopolitical Risks

Geopolitical risks, such as conflicts, trade disputes, and international sanctions, can significantly impact emerging markets. These risks can disrupt economic activities, trade flows, and investor sentiment. Examples of geopolitical risks include:

Regional Conflicts: Military conflicts or territorial disputes between neighboring countries.

Trade Wars: Imposition of tariffs and trade barriers that affect cross-border commerce.

Sanctions: Economic sanctions imposed by other countries or international organizations.

Social and Environmental Challenges

Emerging markets may face social and environmental challenges that can affect investments. These include:

Income Inequality: Widening income gaps can lead to social unrest and political instability.

Environmental Degradation: Pollution, deforestation, and resource depletion can impact long-term economic sustainability.

Labor Issues: Poor labor practices and working conditions can lead to strikes, legal disputes, and reputational risks.

Strategies for Investing in Emerging Markets

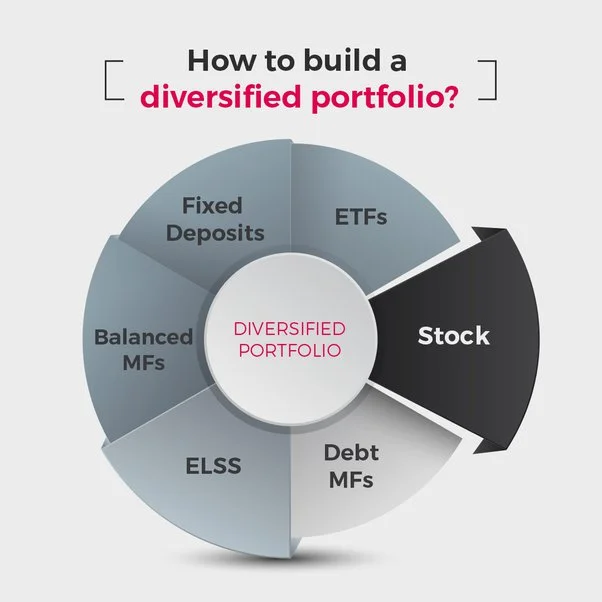

Diversification

Diversification is a key strategy for managing risks in emerging markets. By spreading investments across multiple countries, sectors, and asset classes, investors can reduce the impact of country-specific or sector-specific risks. Diversification can be achieved through:

Geographic Diversification: Investing in a range of emerging market countries with different economic profiles and risk factors.

Sector Diversification: Allocating investments across various industries, such as technology, finance, consumer goods, and natural resources.

Asset Class Diversification: Combining equities, fixed income, real estate, and alternative investments to balance risk and return.

Research and Due Diligence

Thorough research and due diligence are essential when investing in emerging markets. Investors should:

Analyze Economic Indicators: Monitor key economic indicators, such as GDP growth, inflation rates, and trade balances, to assess the economic health of target markets.

Evaluate Political Stability: Assess the political environment, including government stability, policy consistency, and potential risks of political unrest.

Assess Corporate Governance: Review the corporate governance practices and transparency levels of companies in which you plan to invest.

Understand Local Market Conditions: Gain insights into local market dynamics, including consumer behavior, competitive landscape, and regulatory environment.

Long-Term Perspective

Adopting a long-term perspective can help investors navigate the volatility and risks associated with emerging markets. Long-term investment horizons allow investors to:

Ride Out Volatility: Weather short-term market fluctuations and benefit from long-term growth trends.

Capture Compounding: Take advantage of the power of compounding returns over time.

Align with Economic Development: Invest in companies and sectors poised to benefit from long-term economic development and structural reforms.

Risk Management

Effective risk management is crucial for investing in emerging markets. Key risk management strategies include:

Hedging Currency Risk: Use currency hedging instruments, such as forward contracts and options, to mitigate the impact of currency fluctuations.

Limit Exposure: Set limits on the proportion of your portfolio allocated to emerging markets to manage overall risk.

Stay Informed: Regularly monitor economic, political, and market developments in emerging markets to identify potential risks and opportunities.

Professional Advice

Seeking professional advice can be beneficial for navigating the complexities of emerging markets. Financial advisors, investment managers, and research analysts can provide valuable insights and recommendations based on their expertise and experience. Consider working with professionals who have a strong track record and in-depth knowledge of emerging markets.

Case Studies: Successful Emerging Market Investments

Case Study 1: Alibaba Group (China)

Alibaba Group, founded in 1999 by Jack Ma, has grown to become one of the world’s largest e-commerce companies. The company’s initial public offering (IPO) in 2014 on the New York Stock Exchange was the largest IPO in history at the time, raising $25 billion. Alibaba’s success can be attributed to:

Strong Market Position: Dominance in the Chinese e-commerce market with platforms like Taobao and Tmall.

Innovative Business Model: Diversification into cloud computing, digital payments (Alipay), and entertainment.

Economic Growth: Benefiting from China’s rapid economic growth and rising consumer spending.

Investors who recognized Alibaba’s potential early on and held their investments through market fluctuations have seen substantial returns.

Case Study 2: HDFC Bank (India)

HDFC Bank, one of India’s leading private sector banks, has consistently delivered strong financial performance and shareholder returns. Key factors contributing to HDFC Bank’s success include:

Robust Financials: Strong balance sheet, low non-performing asset (NPA) ratios, and consistent profitability.

Expanding Customer Base: Growth in retail banking, digital banking, and small and medium-sized enterprise (SME) lending.

Regulatory Reforms: Benefiting from India’s financial sector reforms and initiatives to promote financial inclusion.

Long-term investors in HDFC Bank have been rewarded with significant capital appreciation and dividend income.

Case Study 3: Vale S.A. (Brazil)

Vale S.A., a Brazilian multinational corporation, is one of the world’s largest producers of iron ore and nickel. The company’s growth and success are driven by:

Resource Richness: Access to vast reserves of iron ore and other minerals.

Global Demand: Strong demand for iron ore from industrializing countries, particularly China.

Operational Efficiency: Investments in technology and infrastructure to enhance mining and logistics operations.

Investors who recognized the strategic importance of Vale’s resources and global market position have benefited from substantial returns, particularly during commodity booms.

Investing in emerging markets offers a compelling opportunity to tap into high growth potential, diversify portfolios, and gain exposure to undervalued assets and natural resources. However, these opportunities come with significant risks, including political and economic instability, currency risk, market liquidity challenges, and corporate governance issues.

By employing strategies such as diversification, thorough research, long-term investment perspectives, risk management, and seeking professional advice, investors can navigate the complexities of emerging markets and potentially achieve substantial returns.

As the global economy continues to evolve, emerging markets will play an increasingly important role in shaping the future of investment opportunities. Investors who understand the dynamics of these markets and are prepared to manage the associated risks can position themselves to capitalize on the growth and development of some of the world’s most dynamic and promising economies.