Entering the professional world is an exciting milestone for young individuals. Along with newfound independence and responsibility comes the crucial task of managing personal finances. Establishing good financial habits early on can lead to a secure and prosperous future. This comprehensive guide provides essential personal finance tips for young professionals to help navigate this important aspect of adulthood.

Contents

1. Create a Budget and Stick to It

Budgeting is the foundation of sound financial management. Start by tracking your income and expenses for a few months to understand your spending patterns. Once you have a clear picture, create a realistic budget that allocates funds to necessary expenses, savings, and discretionary spending. Popular budgeting methods include:

50/30/20 Rule: Allocate 50% of your income to needs (rent, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

Zero-Based Budgeting: Every dollar is assigned a job, ensuring that your income minus your expenses equals zero. This method helps in ensuring that no money is wasted.

2. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can provide a financial safety net in times of unexpected expenses like medical emergencies, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account. This fund should be easily accessible but separate from your regular checking account to avoid unnecessary spending.

3. Manage Debt Wisely

Many young professionals start their careers with student loans or credit card debt. Managing this debt effectively is crucial to financial health. Here are some strategies:

Pay More Than the Minimum: Paying only the minimum amount on your loans or credit cards can extend the repayment period and increase the total interest paid. Aim to pay more than the minimum to reduce your debt faster.

Consider Refinancing or Consolidation: If you have high-interest debt, look into refinancing options to lower your interest rate or consolidating multiple debts into one loan with a lower rate.

Avoid Accumulating New Debt: Be cautious with credit card usage and avoid taking on new debt unless absolutely necessary.

4. Invest in Your Future

Starting to invest early can significantly impact your financial future due to the power of compound interest. Here are some investment tips:

Retirement Accounts: Contribute to employer-sponsored retirement plans like a 401(k) or 403(b), especially if your employer offers a match. Additionally, consider opening an Individual Retirement Account (IRA) for tax-advantaged growth.

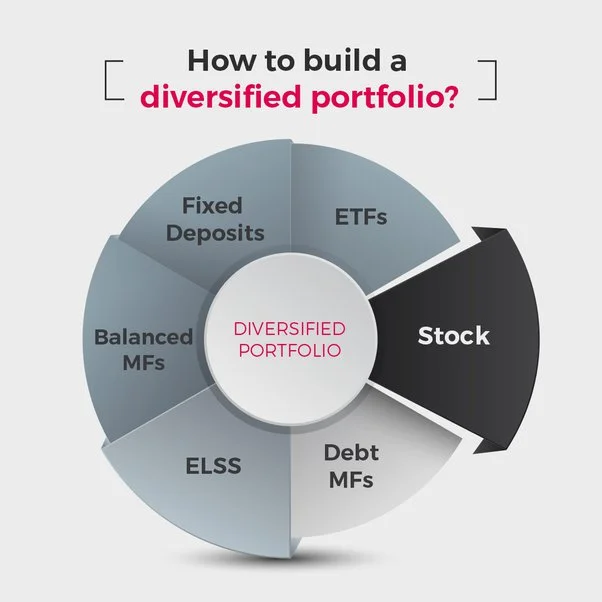

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes like stocks, bonds, and real estate to spread risk.

Educate Yourself: Take time to learn about different investment options and strategies. Consider speaking with a financial advisor to tailor an investment plan that aligns with your goals.

5. Live Below Your Means

It’s tempting to upgrade your lifestyle with your new income, but living below your means is essential for long-term financial stability. This doesn’t mean you can’t enjoy life, but it’s about making conscious spending decisions and avoiding lifestyle inflation. Focus on needs over wants and find joy in cost-effective activities.

6. Build Good Credit

Your credit score impacts your ability to borrow money, rent an apartment, and even get a job in some cases. Building good credit early is crucial. Here’s how:

Pay Bills on Time: Late payments can significantly damage your credit score. Set up automatic payments or reminders to ensure you pay all bills on time.

Keep Credit Utilization Low: Aim to use less than 30% of your available credit limit. High credit utilization can negatively affect your credit score.

Monitor Your Credit Report: Regularly check your credit report for errors and signs of identity theft. You’re entitled to a free credit report from each of the three major credit bureaus annually at AnnualCreditReport.com.

7. Protect Yourself with Insurance

Insurance is a crucial part of financial planning. Ensure you have adequate coverage for:

Health Insurance: Protects you from high medical costs. If your employer offers health insurance, take advantage of it. If not, explore other options available in the market.

Renter’s or Homeowner’s Insurance: Protects your personal property and provides liability coverage.

Disability Insurance: Provides income if you’re unable to work due to a disability.

Life Insurance: If you have dependents, life insurance can provide financial security for them in the event of your untimely death.

8. Plan for Major Purchases

Whether it’s buying a car, a home, or planning a wedding, major purchases require careful financial planning. Save for these goals separately to avoid dipping into your emergency fund or taking on unnecessary debt. Research and compare financing options to find the best deals and ensure your purchase fits within your budget.

9. Continue Your Education

Investing in your education can lead to higher earning potential and career advancement. Consider taking courses, attending workshops, or obtaining certifications in your field. Many employers offer tuition reimbursement programs, so take advantage of these opportunities if available.

10. Seek Professional Advice

Navigating personal finance can be complex, and seeking professional advice can be beneficial. Financial advisors can help you create a comprehensive financial plan, manage investments, and provide guidance tailored to your specific situation. Look for a certified financial planner (CFP) who adheres to a fiduciary standard, meaning they are required to act in your best interest.

Managing personal finances effectively is a critical skill for young professionals. By creating a budget, building an emergency fund, managing debt, investing for the future, living below your means, building good credit, protecting yourself with insurance, planning for major purchases, continuing your education, and seeking professional advice, you can establish a solid financial foundation. Remember, the habits you develop now will shape your financial well-being for years to come. Start today and pave the way to a secure and prosperous future.