Retirement is a significant milestone in a person’s life, representing a transition from years of active employment to a phase of relaxation and enjoyment. However, achieving a comfortable retirement requires careful planning and foresight. The earlier you start planning for retirement, the more likely you are to retire rich and enjoy financial security in your golden years. This article will explore the importance of early retirement planning, key strategies to build a robust retirement portfolio, and practical steps to ensure a financially secure future.

Contents

- 1 The Importance of Early Retirement Planning

- 2 Mitigating Risk Through Time

- 3 Maximizing Employer Benefits

- 4 Key Strategies for Building a Robust Retirement Portfolio

- 5 Regular Contributions and Automatic Investing

- 6 Tax-Advantaged Accounts

- 7 Practical Steps to Ensure a Financially Secure Future

- 8 Creating a Budget and Managing Debt

- 9 Emergency Fund

- 10 Staying Informed and Seeking Professional Advice

- 11 Overcoming Common Retirement Planning Challenges

- 12 Underestimating Retirement Expenses

- 13 Market Volatility and Economic Uncertainty

- 14 Case Studies: Successful Early Retirement Planning

- 15 Additional Resources

The Importance of Early Retirement Planning

Compound Interest: The Eighth Wonder of the World

One of the most compelling reasons to start planning for retirement early is the power of compound interest. Albert Einstein reportedly called compound interest the “eighth wonder of the world,” and for a good reason. Compound interest allows your investments to grow exponentially over time. When you reinvest your earnings, you earn returns not only on your initial investment but also on the accumulated interest from previous periods.

For example, if you start investing $200 a month at the age of 25 with an annual return of 7%, by the time you reach 65, you would have approximately $528,000. However, if you start the same investment at 35, you would have only around $244,000 by 65. The difference of $284,000 highlights the significant impact of starting early.

Mitigating Risk Through Time

Starting your retirement planning early allows you to take advantage of a longer time horizon, which helps mitigate risks associated with market volatility. Younger investors can afford to take on more risk because they have more time to recover from potential market downturns. Over decades, the stock market has historically trended upwards despite short-term fluctuations. By starting early, you can invest in higher-risk, higher-reward assets with the confidence that you have time to weather any storms.

Maximizing Employer Benefits

Many employers offer retirement benefits such as 401(k) plans with matching contributions. Starting your retirement planning early ensures that you take full advantage of these benefits. Employer matching is essentially free money that can significantly boost your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing the full 6% will maximize your benefits and accelerate your savings growth.

Key Strategies for Building a Robust Retirement Portfolio

Diversification: Don’t Put All Your Eggs in One Basket

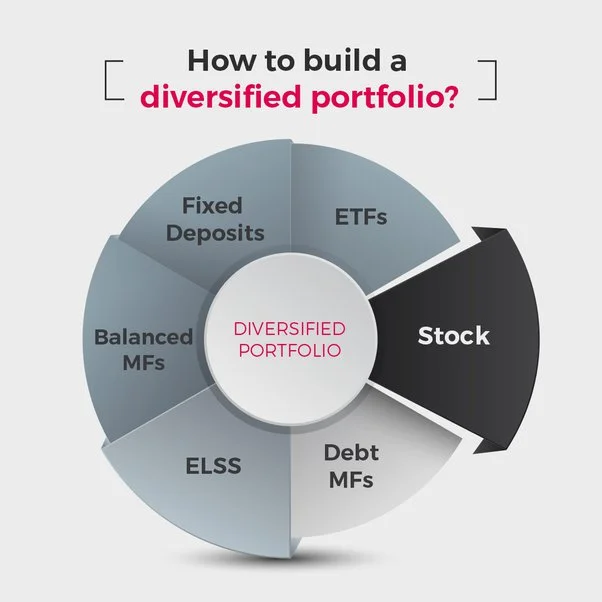

Diversification is a crucial strategy for building a robust retirement portfolio. By spreading your investments across various asset classes, you reduce the risk of significant losses. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and other investment vehicles.

Stocks: Stocks offer the potential for high returns and should be a significant component of a long-term retirement portfolio. Consider investing in a mix of domestic and international stocks to further diversify your holdings.

Bonds: Bonds are generally considered safer investments compared to stocks. They provide regular interest payments and can help balance the higher volatility of stocks. Include both government and corporate bonds in your portfolio for added security.

Real Estate: Real estate investments can provide steady rental income and long-term appreciation. Consider investing in real estate investment trusts (REITs) if direct property ownership is not feasible.

Other Investments: Depending on your risk tolerance, you might include other investments such as commodities, mutual funds, or exchange-traded funds (ETFs).

Regular Contributions and Automatic Investing

Consistency is key when it comes to building a robust retirement portfolio. Regular contributions, no matter how small, can significantly impact your overall savings due to the compounding effect. Setting up automatic contributions to your retirement accounts ensures that you remain disciplined and avoid the temptation to skip or reduce contributions.

Tax-Advantaged Accounts

Utilizing tax-advantaged accounts can enhance your retirement savings by reducing your tax burden. Common tax-advantaged accounts include:

401(k): Contributions to a traditional 401(k) are made with pre-tax dollars, reducing your taxable income for the year. Roth 401(k) contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

IRA: Individual Retirement Accounts (IRAs) offer similar tax advantages. Traditional IRA contributions are tax-deductible, while Roth IRA contributions are made with after-tax dollars but grow tax-free.

Health Savings Accounts (HSAs): HSAs are another tax-advantaged option if you have a high-deductible health plan. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Practical Steps to Ensure a Financially Secure Future

Setting Clear Goals

Setting clear and realistic retirement goals is the first step toward a financially secure future. Consider factors such as your desired retirement age, lifestyle, and estimated expenses. Use retirement calculators to estimate how much you need to save to achieve your goals. Having a clear target in mind will help you stay motivated and focused on your retirement planning journey.

Creating a Budget and Managing Debt

Creating a budget is essential for managing your finances and ensuring that you can allocate funds toward retirement savings. Track your income and expenses to identify areas where you can cut back and save more. Additionally, managing and reducing debt is crucial. High-interest debt can significantly hinder your ability to save for retirement. Focus on paying off credit card debt, student loans, and other high-interest obligations as quickly as possible.

Emergency Fund

Building an emergency fund is a critical aspect of financial planning. An emergency fund provides a safety net for unexpected expenses, such as medical emergencies or job loss, without derailing your retirement savings. Aim to save at least three to six months’ worth of living expenses in a readily accessible account.

Staying Informed and Seeking Professional Advice

The financial landscape is constantly evolving, making it essential to stay informed about changes that could impact your retirement planning. Subscribe to financial news, attend workshops, and read books on personal finance and investing. Additionally, seeking professional advice from a financial advisor can provide personalized guidance and help you make informed decisions. A financial advisor can assist with creating a comprehensive retirement plan, selecting appropriate investments, and adjusting your strategy as needed.

Overcoming Common Retirement Planning Challenges

Procrastination and Lack of Discipline

Procrastination is one of the biggest obstacles to successful retirement planning. Many people delay starting their retirement savings, believing they have plenty of time. Overcoming procrastination requires a mindset shift. Recognize the long-term benefits of starting early and commit to taking small, consistent steps toward your goals. Setting up automatic contributions and reminders can help maintain discipline.

Underestimating Retirement Expenses

Underestimating the amount needed for retirement is a common mistake. Many people focus solely on their current expenses without accounting for potential changes in lifestyle, healthcare costs, and inflation. To avoid this pitfall, regularly review and adjust your retirement goals and savings plan. Consider factors such as increased healthcare expenses, travel, and hobbies you wish to pursue during retirement.

Market Volatility and Economic Uncertainty

Market volatility and economic uncertainty can create anxiety for investors. While it’s impossible to predict market movements, having a diversified portfolio and a long-term perspective can help mitigate risks. Avoid making impulsive decisions based on short-term market fluctuations. Instead, stick to your investment strategy and make adjustments as needed based on your financial goals and risk tolerance.

Case Studies: Successful Early Retirement Planning

Case Study 1: The Power of Starting Early

John, a 25-year-old software engineer, began contributing $300 per month to his Roth IRA with an annual return of 8%. By the age of 65, John had accumulated approximately $1.1 million. His early start allowed him to take full advantage of compound interest and achieve financial independence well before retirement age.

Case Study 2: Overcoming Debt and Building Wealth

Maria, a 30-year-old teacher, had significant student loan debt. She created a budget and aggressively paid off her loans while contributing 5% of her salary to her 401(k). Once her debt was paid off, she increased her retirement contributions to 15%. By maintaining discipline and prioritizing her financial goals, Maria was on track to retire comfortably by the age of 65.

Case Study 3: Diversification and Professional Guidance

Sam and Lisa, a married couple in their early 40s, sought the help of a financial advisor to create a comprehensive retirement plan. Their advisor recommended a diversified portfolio, including stocks, bonds, and real estate. They also maximized their contributions to tax-advantaged accounts. With professional guidance, Sam and Lisa felt confident in their retirement strategy and were able to stay on track despite market fluctuations.

Retirement planning is a lifelong journey that requires careful planning, discipline, and a proactive approach. Starting early is the key to unlocking the full potential of compound interest and achieving financial security in your golden years. By setting clear goals, creating a budget, managing debt, and staying informed, you can build a robust retirement portfolio and enjoy a comfortable retirement. Remember, the journey to a rich retirement begins today. Take the first step, stay committed, and watch your wealth grow over time.

Additional Resources

Books:

“The Simple Path to Wealth” by JL Collins

“Rich Dad Poor Dad” by Robert T. Kiyosaki

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Tools:

Retirement calculators from financial institutions like Vanguard, Fidelity, and Charles Schwab

Budgeting apps like Mint and YNAB (You Need A Budget)

By leveraging these resources and implementing the strategies discussed, you can pave the way for a financially secure and fulfilling retirement. Start early, stay disciplined, and embrace the journey toward a rich retirement