Cryptocurrencies have rapidly emerged as a significant asset class, revolutionizing the financial landscape. From the advent of Bitcoin in 2009 to the proliferation of thousands of digital currencies today, the cryptocurrency market has seen explosive growth. This comprehensive guide explores the rise of cryptocurrency, providing investors with essential knowledge to navigate this dynamic and evolving market.

Contents [hide]

Understanding the Rise of Cryptocurrency

Cryptocurrency is a digital or virtual form of money that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. Here are some key aspects to understand:

Blockchain Technology: At the core of cryptocurrencies is blockchain technology, a distributed ledger that records all transactions across a network of computers. This ensures transparency, security, and immutability.

Decentralization: Cryptocurrencies are typically decentralized, meaning they are not controlled by any single entity such as a central bank or government. This decentralization reduces the risk of manipulation and enhances security.

Cryptographic Security: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. This makes them resistant to fraud and counterfeiting.

Major Cryptocurrencies

While thousands of cryptocurrencies exist, a few have gained prominence due to their market capitalization, adoption, and technological advancements. Some of the major cryptocurrencies include:

Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin was created by an anonymous person or group known as Satoshi Nakamoto. It is often referred to as digital gold due to its store of value properties.

Ethereum (ETH): Ethereum introduced the concept of smart contracts, enabling developers to create decentralized applications (DApps) on its blockchain. Ether (ETH) is the native cryptocurrency of the Ethereum network.

Ripple (XRP): Ripple focuses on facilitating real-time cross-border payments. Its consensus ledger is designed to process transactions quickly and efficiently.

Litecoin (LTC): Often considered the silver to Bitcoin’s gold, Litecoin offers faster transaction times and a different hashing algorithm.

Bitcoin Cash (BCH): A fork of Bitcoin, Bitcoin Cash was created to address scalability issues by increasing the block size limit.

The Appeal of Cryptocurrencies

Cryptocurrencies offer several advantages that have attracted investors and users worldwide:

Decentralization and Security: The decentralized nature of cryptocurrencies makes them less vulnerable to government interference and centralized control. Blockchain technology ensures the security and integrity of transactions.

Potential for High Returns: Cryptocurrencies have demonstrated significant price appreciation, offering investors the potential for high returns. Early adopters of Bitcoin, for example, have seen substantial gains.

Inflation Hedge: Some investors view cryptocurrencies, particularly Bitcoin, as a hedge against inflation. With a fixed supply of 21 million coins, Bitcoin is seen as a deflationary asset.

Innovation and Disruption: Cryptocurrencies are driving innovation in various industries, from finance and supply chain management to healthcare and gaming. This disruptive potential attracts investors seeking exposure to cutting-edge technology.

Risks and Challenges

Despite their appeal, cryptocurrencies come with inherent risks and challenges that investors must consider:

Volatility: Cryptocurrencies are known for their price volatility. While this presents opportunities for significant gains, it also poses the risk of substantial losses.

Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving. Changes in regulations or government policies can impact the market and affect the value of digital assets.

Security Risks: While blockchain technology is secure, the broader ecosystem, including exchanges and wallets, can be vulnerable to hacking and fraud. Investors must take measures to secure their assets.

Market Manipulation: The relatively nascent and less regulated nature of the cryptocurrency market makes it susceptible to market manipulation, including pump-and-dump schemes.

Lack of Consumer Protections: Unlike traditional financial systems, the cryptocurrency market lacks established consumer protections. Investors must exercise due diligence and be aware of potential scams.

Investment Strategies

Investing in cryptocurrencies requires a thoughtful approach and a clear understanding of the market dynamics. Here are some strategies for investing in cryptocurrencies:

Research and Education: Thoroughly research the cryptocurrencies you are interested in. Understand their use cases, technology, development team, and market potential. Stay informed about market trends and news.

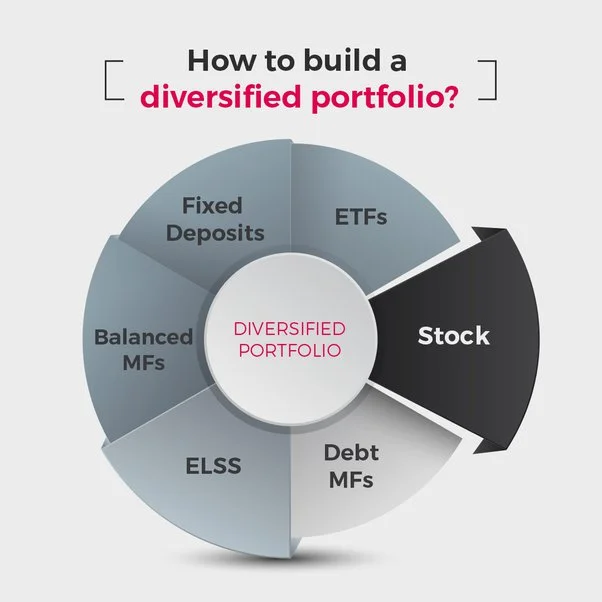

Diversification: Diversify your cryptocurrency portfolio to spread risk. Consider allocating investments across different cryptocurrencies, sectors, and market capitalizations.

Long-Term Holding (HODLing): Some investors adopt a long-term holding strategy, believing in the long-term potential of cryptocurrencies. This approach involves buying and holding digital assets despite short-term volatility.

Trading: Active trading involves buying and selling cryptocurrencies to capitalize on short-term price movements. This strategy requires technical analysis, market knowledge, and a disciplined approach.

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency’s price. This strategy reduces the impact of volatility and can lead to a lower average cost over time.

Regulatory Landscape

The regulatory environment for cryptocurrencies varies significantly across different jurisdictions. Here are some notable regulatory approaches:

United States: The U.S. has a complex regulatory framework, with various agencies such as the SEC, CFTC, and IRS overseeing different aspects of the cryptocurrency market. Regulatory clarity is gradually improving, with a focus on investor protection and anti-money laundering (AML) measures.

European Union: The EU is working on comprehensive regulations, including the proposed Markets in Crypto-Assets (MiCA) regulation, aimed at creating a harmonized regulatory framework across member states.

Asia: Countries like Japan and South Korea have embraced cryptocurrencies with clear regulations, while China has taken a more restrictive approach, banning cryptocurrency trading and initial coin offerings (ICOs).

Emerging Markets: In regions like Africa and Latin America, cryptocurrencies are gaining traction as a means of financial inclusion and remittances, with varying levels of regulatory oversight.

Future Trends and Developments

The cryptocurrency market continues to evolve rapidly, with several trends and developments shaping its future:

Institutional Adoption: Increasing institutional interest and investment in cryptocurrencies are driving market growth and maturity. Major financial institutions and corporations are exploring digital assets and blockchain technology.

Decentralized Finance (DeFi): DeFi platforms are creating decentralized financial services such as lending, borrowing, and trading, leveraging blockchain technology to eliminate intermediaries.

Central Bank Digital Currencies (CBDCs): Governments and central banks are exploring the issuance of digital currencies. CBDCs could coexist with cryptocurrencies, offering a digital form of traditional fiat currency.

NFTs and Digital Assets: Non-fungible tokens (NFTs) have gained popularity as unique digital assets representing ownership of art, music, and other digital content. NFTs are expanding the use cases for blockchain technology.

Scalability Solutions: Ongoing development of scalability solutions, such as Ethereum 2.0 and layer-2 protocols, aims to enhance the transaction throughput and efficiency of blockchain networks.

Practical Considerations for Investors

For investors considering entering the cryptocurrency market, here are some practical considerations:

Secure Your Investments: Use reputable exchanges and wallets. Consider hardware wallets for added security. Enable two-factor authentication (2FA) and practice good cybersecurity hygiene.

Stay Informed: Follow reputable news sources, join cryptocurrency communities, and stay updated on market developments. Knowledge is crucial for making informed investment decisions.

Start Small: If you are new to cryptocurrencies, start with a small investment. Gain experience and gradually increase your exposure as you become more comfortable with the market.

Seek Professional Advice: Consider consulting with a financial advisor who has experience with cryptocurrencies. They can provide personalized guidance based on your financial goals and risk tolerance.

Be Prepared for Volatility: Understand that cryptocurrency investments can be highly volatile. Be prepared for significant price fluctuations and avoid making impulsive decisions based on short-term market movements.

The rise of cryptocurrency represents a transformative shift in the financial landscape, offering new opportunities and challenges for investors. By understanding the fundamentals of cryptocurrencies, the benefits and risks, investment strategies, and the regulatory environment, investors can navigate this dynamic market with confidence.

As the cryptocurrency ecosystem continues to evolve, staying informed and adaptable will be key to making successful investment decisions. Whether you are a seasoned investor or just beginning your journey into the world of digital assets, a thoughtful and informed approach will help you capitalize on the potential of this exciting and rapidly growing market

Read more: