Artificial Intelligence (AI) is revolutionizing various sectors, and financial planning is no exception. AI technologies are reshaping how financial planning is conducted, making it more efficient, accurate, and personalized. This comprehensive article explores the transformative impact of AI on financial planning, delving into its benefits, applications, challenges, and future prospects.

Contents

- 1 Introduction to AI in Financial Planning

- 2 Benefits of AI in Financial Planning

- 3 Applications of AI in Financial Planning

- 4 Predictive Analytics

- 5 Natural Language Processing (NLP)

- 6 Benefits of NLP

- 7 Chatbots and Virtual Assistants

- 8 Portfolio Management

- 9 Fraud Detection and Prevention

- 10 Challenges of AI in Financial Planning

- 11 Regulatory Challenges

- 12 Future Prospects of AI in Financial Planning

Introduction to AI in Financial Planning

What is Artificial Intelligence?

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines programmed to think and learn like humans. These intelligent systems can perform tasks such as problem-solving, decision-making, and pattern recognition. AI encompasses various subfields, including machine learning, natural language processing, and robotics.

Evolution of Financial Planning

Financial planning involves creating strategies to manage finances and achieve long-term financial goals. Traditionally, financial planning relied heavily on manual calculations, spreadsheets, and human advisors. While these methods are effective, they can be time-consuming and prone to human error. The integration of AI into financial planning aims to enhance accuracy, efficiency, and personalization.

Benefits of AI in Financial Planning

Improved Accuracy and Efficiency

AI algorithms can process vast amounts of data with high precision and speed, significantly reducing the likelihood of errors. Automated systems can quickly analyze financial information, identify trends, and generate accurate forecasts, saving time and effort for both financial planners and clients.

Personalized Financial Advice

AI-driven financial planning tools can offer personalized advice tailored to individual needs and preferences. By analyzing data such as spending habits, income, and financial goals, AI systems can create customized financial plans that align with a client’s unique circumstances.

Enhanced Decision-Making

AI can assist in making more informed financial decisions by providing insights based on data analysis. Machine learning models can identify patterns and trends that may not be apparent to human advisors, helping clients make better investment choices and risk assessments.

Cost Reduction

AI-powered financial planning tools can reduce costs by automating routine tasks and minimizing the need for human intervention. This allows financial planning firms to offer their services at a lower cost, making financial planning more accessible to a broader audience.

24/7 Availability

AI-driven financial planning tools are available 24/7, allowing clients to access financial advice and support at any time. This continuous availability enhances the client experience and ensures that financial planning is not limited to business hours.

Applications of AI in Financial Planning

Robo-Advisors

Definition and Functionality

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with minimal human supervision. These platforms use AI to create and manage investment portfolios based on a client’s financial goals, risk tolerance, and time horizon.

Benefits of Robo-Advisors

Accessibility: Robo-advisors offer financial planning services to a broader audience, including those who may not have access to traditional financial advisors.

Lower Fees: Automated services typically come with lower fees compared to traditional advisory services.

Customization: Robo-advisors provide personalized investment strategies based on individual preferences and goals.

Predictive Analytics

Definition and Functionality

Predictive analytics involves using AI algorithms to analyze historical data and make predictions about future outcomes. In financial planning, predictive analytics can forecast market trends, identify investment opportunities, and assess potential risks.

Benefits of Predictive Analytics

Improved Forecasting: More accurate predictions of market trends and investment performance.

Risk Management: Enhanced ability to identify and mitigate potential financial risks.

Data-Driven Decisions: Support for making informed investment decisions based on data analysis.

Natural Language Processing (NLP)

Definition and Functionality

Natural Language Processing (NLP) is a branch of AI that enables machines to understand and process human language. In financial planning, NLP can be used to analyze unstructured data, such as news articles, social media posts, and financial reports, to extract valuable insights.

Benefits of NLP

Sentiment Analysis: Understanding market sentiment and its potential impact on investments.

Automated Reporting: Generating financial reports and summaries from unstructured data sources.

Enhanced Client Communication: Improved communication with clients through chatbots and virtual assistants.

Chatbots and Virtual Assistants

Definition and Functionality

Chatbots and virtual assistants are AI-driven tools that can interact with clients, answer questions, and provide financial advice. These tools use NLP to understand client queries and provide relevant responses.

Benefits of Chatbots and Virtual Assistants

24/7 Support: Continuous availability to assist clients at any time.

Scalability: Ability to handle a large number of client interactions simultaneously.

Efficiency: Quick and accurate responses to client inquiries.

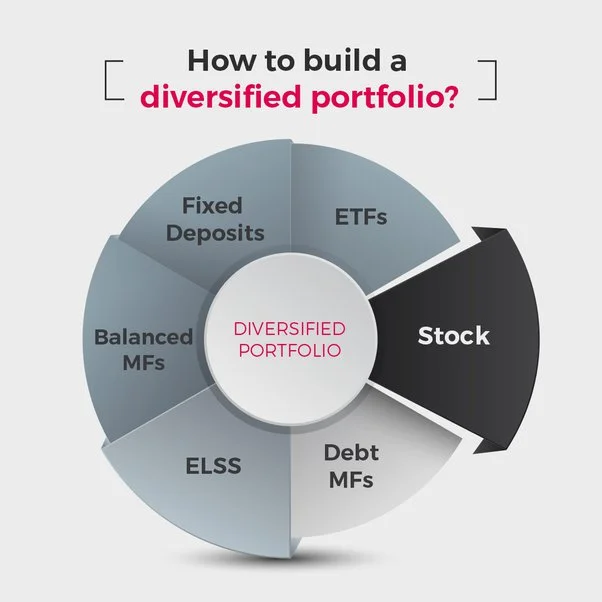

Portfolio Management

Definition and Functionality

AI-powered portfolio management tools use machine learning algorithms to optimize investment portfolios. These tools analyze market data, investment performance, and client preferences to create and manage portfolios that maximize returns and minimize risks.

Benefits of AI in Portfolio Management

Dynamic Adjustments: Real-time adjustments to portfolios based on market conditions and performance.

Risk Mitigation: Identification and management of potential risks to protect investments.

Personalization: Tailored investment strategies that align with individual financial goals.

Fraud Detection and Prevention

Definition and Functionality

AI can be used to detect and prevent fraudulent activities in financial planning. Machine learning models can analyze transaction data and identify patterns indicative of fraud, enabling timely intervention.

Benefits of AI in Fraud Detection

Early Detection: Identification of fraudulent activities before they cause significant damage.

Automated Monitoring: Continuous monitoring of transactions for potential fraud.

Enhanced Security: Improved protection of client assets and financial information.

Challenges of AI in Financial Planning

Data Privacy and Security

Concerns

The use of AI in financial planning requires access to vast amounts of sensitive financial data. Ensuring the privacy and security of this data is a significant concern.

Mitigation Strategies

Data Encryption: Implementing strong encryption protocols to protect data.

Regulatory Compliance: Adhering to data protection regulations, such as GDPR and CCPA.

Access Controls: Restricting access to sensitive data to authorized personnel only.

Algorithmic Bias

Concerns

AI algorithms can be biased if they are trained on biased data. This can lead to unfair treatment and discrimination in financial planning.

Mitigation Strategies

Diverse Data: Using diverse and representative datasets for training AI models.

Regular Audits: Conducting regular audits of AI algorithms to identify and address biases.

Transparency: Ensuring transparency in how AI models are developed and used.

Lack of Human Touch

Concerns

While AI can automate many aspects of financial planning, it may lack the personal touch and empathy that human advisors provide.

Mitigation Strategies

Hybrid Models: Combining AI-driven tools with human advisors to provide personalized and empathetic advice.

Client Education: Educating clients about the benefits and limitations of AI in financial planning.

Feedback Mechanisms: Implementing feedback mechanisms to continuously improve AI-driven services.

Regulatory Challenges

Concerns

The use of AI in financial planning is subject to regulatory scrutiny. Ensuring compliance with evolving regulations can be challenging.

Mitigation Strategies

Regulatory Compliance Teams: Establishing dedicated teams to monitor and ensure compliance with regulations.

Collaboration with Regulators: Engaging with regulators to stay informed about regulatory changes and requirements.

Regular Training: Providing regular training to employees on regulatory compliance and best practices.

Future Prospects of AI in Financial Planning

Advancements in AI Technology

The future of AI in financial planning is promising, with ongoing advancements in AI technology expected to further enhance its capabilities. Key areas of development include:

Explainable AI (XAI): Improving the transparency and interpretability of AI models to enhance trust and accountability.

Reinforcement Learning: Using reinforcement learning to develop more sophisticated and adaptive financial planning algorithms.

AI-Driven Behavioral Finance: Integrating AI with behavioral finance to better understand and address clients’ financial behaviors and biases.

Increased Adoption

As AI technology continues to evolve, its adoption in financial planning is expected to increase. More financial planning firms and individual advisors are likely to integrate AI-driven tools into their practices to enhance efficiency, accuracy, and personalization.

Enhanced Client Experience

AI-driven financial planning tools will continue to improve the client experience by offering more personalized, data-driven, and real-time financial advice. Clients will benefit from greater accessibility, convenience, and tailored financial strategies.

Collaboration Between AI and Human Advisors

The future of financial planning will likely involve greater collaboration between AI and human advisors. Hybrid models that combine the strengths of AI-driven tools with the empathy and expertise of human advisors will become more prevalent, offering a holistic approach to financial planning.

Artificial Intelligence is playing an increasingly important role in transforming financial planning. From improving accuracy and efficiency to providing personalized financial advice and enhancing decision-making, AI offers numerous benefits that can significantly improve the financial planning process. However, challenges such as data privacy, algorithmic bias, and regulatory compliance must be addressed to fully realize the potential of AI in this field.

As AI technology continues to advance, its impact on financial planning is expected to grow, offering new opportunities for both financial planners and clients. By leveraging AI-driven tools and strategies, financial planners can enhance their services, provide more value to their clients, and navigate the complexities of the modern financial landscape with greater confidence and precision.