Dividend investing is a strategy focused on buying stocks that pay regular dividends. It can provide a steady income stream and potential capital appreciation, making it an attractive approach for long-term investors. This comprehensive guide explores the principles, benefits, risks, and strategies of dividend investing, offering tips to help you succeed in building a robust dividend portfolio.

Contents

Understanding Dividend Investing

What is Dividend Investing?

Dividend investing involves purchasing shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. These payments are typically made quarterly, providing investors with regular income in addition to any potential capital gains from stock price appreciation.

Types of Dividends

Cash Dividends: The most common type, paid in cash directly to shareholders’ brokerage accounts.

Stock Dividends: Additional shares issued to shareholders instead of cash, increasing the total number of shares owned.

Special Dividends: One-time payments made by companies, often from surplus profits or asset sales.

Preferred Dividends: Payments made to preferred stockholders, usually at a fixed rate.

Key Metrics in Dividend Investing

Dividend Yield: The annual dividend payment divided by the stock price, expressed as a percentage. It measures the income generated relative to the investment.

Dividend Payout Ratio: The percentage of earnings paid out as dividends. A lower ratio suggests the company retains more earnings for growth, while a higher ratio indicates a focus on returning profits to shareholders.

Dividend Growth Rate: The annualized percentage growth of a company’s dividend over time. Consistent dividend growth is a positive indicator of financial health and management confidence.

Total Return: The combination of dividend income and capital appreciation. This metric provides a holistic view of investment performance.

Benefits of Dividend Investing

1. Steady Income Stream

Dividends provide a regular income stream, which can be particularly valuable for retirees or those seeking passive income. The predictability of dividend payments can help in budgeting and financial planning.

2. Potential for Capital Appreciation

In addition to income, dividend-paying stocks can appreciate in value over time. Companies that consistently pay and grow dividends are often financially strong and well-managed, contributing to long-term capital gains.

3. Compounding Returns

Reinvesting dividends can significantly boost returns through compounding. By using dividends to purchase more shares, investors can increase their dividend income and capital appreciation over time.

4. Lower Volatility

Dividend-paying stocks tend to be less volatile than non-dividend-paying stocks. Companies that pay dividends are often more established and financially stable, providing a cushion against market fluctuations.

5. Inflation Hedge

Dividend growth can outpace inflation, helping to maintain purchasing power. Companies that regularly increase dividends often have pricing power and resilient business models, enabling them to adjust for inflation.

Risks of Dividend Investing

1. Dividend Cuts

Companies may reduce or eliminate dividends due to financial difficulties, economic downturns, or changes in business strategy. Dividend cuts can lead to a decrease in stock price and income.

2. Sector Concentration

Dividend stocks are often concentrated in specific sectors, such as utilities, consumer staples, and financials. Lack of diversification can expose investors to sector-specific risks.

3. Interest Rate Sensitivity

Dividend-paying stocks can be sensitive to interest rate changes. Rising interest rates may make bonds more attractive, leading to a sell-off in dividend stocks and potential price declines.

4. Limited Growth Potential

Companies that pay high dividends may reinvest less in growth opportunities, potentially limiting their capital appreciation. This trade-off can impact long-term total returns.

5. Tax Implications

Dividends are subject to taxation, which can reduce the net income received. Tax rates on dividends vary depending on jurisdiction and the investor’s tax bracket.

Strategies for Successful Dividend Investing

1. Focus on Quality

Invest in companies with strong financials, a history of stable or growing dividends, and a sustainable payout ratio. Look for businesses with competitive advantages, solid earnings growth, and low debt levels.

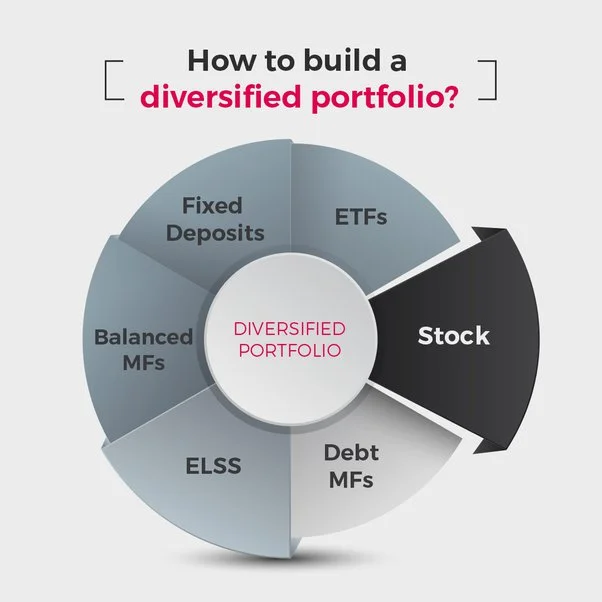

2. Diversify Your Portfolio

Diversify across sectors and industries to mitigate risks. While focusing on high-yield sectors is tempting, a diversified portfolio can better withstand economic and sector-specific downturns.

3. Reinvest Dividends

Reinvesting dividends can compound returns over time. Many brokerage firms offer dividend reinvestment plans (DRIPs) that automatically reinvest dividends into additional shares of the same stock.

4. Monitor Payout Ratios

Keep an eye on payout ratios to ensure dividends are sustainable. A payout ratio above 70-80% may indicate a company is paying out most of its earnings, potentially limiting its ability to sustain or grow dividends.

5. Consider Dividend Growth Stocks

Focus on companies with a history of increasing dividends. Dividend growth stocks often indicate strong financial health and management’s confidence in future earnings.

6. Evaluate Total Return

Consider the total return, which includes both dividend income and capital appreciation. A stock with a lower dividend yield but higher growth potential may provide better overall returns.

7. Assess Financial Health

Review key financial metrics such as earnings per share (EPS), revenue growth, debt levels, and cash flow. Financially healthy companies are more likely to sustain and grow dividends.

8. Stay Informed

Stay updated on company news, earnings reports, and market trends. Changes in business conditions, management, or economic factors can impact dividend policies and stock performance.

9. Use a Long-Term Perspective

Adopt a long-term investment horizon. Dividend investing is most effective when viewed as a long-term strategy, allowing the benefits of compounding and growth to materialize.

10. Consider Tax-Advantaged Accounts

Use tax-advantaged accounts like IRAs or 401(k)s to hold dividend-paying stocks. These accounts can shelter dividends from immediate taxation, enhancing compounding benefits.

Building a Dividend Portfolio

1. Identify Your Goals

Define your investment goals, such as generating income, preserving capital, or achieving long-term growth. Your goals will influence your stock selection and portfolio strategy.

2. Screen for Dividend Stocks

Use financial tools and screeners to identify potential dividend stocks. Criteria may include dividend yield, payout ratio, dividend growth rate, and financial health metrics.

3. Conduct Due Diligence

Thoroughly research potential investments. Review financial statements, management quality, competitive positioning, and industry trends. Consider qualitative factors like business model and corporate governance.

4. Determine Allocation

Decide on your portfolio allocation based on your risk tolerance and investment goals. A balanced approach might include a mix of high-yield stocks, dividend growth stocks, and non-dividend-paying stocks for diversification.

5. Monitor and Rebalance

Regularly review your portfolio to ensure it aligns with your goals and risk tolerance. Rebalance as needed to maintain diversification and adjust to changes in market conditions or company performance.

Case Studies and Examples

1. Blue-Chip Dividend Stocks

Blue-chip stocks are large, well-established companies with a history of reliable dividends. Examples include:

Johnson & Johnson (JNJ): A leading healthcare company with a strong track record of dividend payments and growth.

Procter & Gamble (PG): A consumer goods giant known for its stable earnings and consistent dividend increases.

Coca-Cola (KO): A global beverage leader with a long history of dividend payments and brand strength.

2. Dividend Aristocrats

Dividend Aristocrats are S&P 500 companies that have increased dividends for at least 25 consecutive years. Examples include:

3M (MMM): A diversified technology and manufacturing company with a long history of dividend growth.

PepsiCo (PEP): A leading food and beverage company with a strong track record of increasing dividends.

McDonald’s (MCD): A global fast-food chain known for its consistent dividend payments and growth.

3. High-Yield Dividend Stocks

High-yield stocks offer above-average dividend yields, providing higher income but potentially higher risk. Examples include:

AT&T (T): A telecommunications giant with a high dividend yield, though facing challenges in growth and debt management.

ExxonMobil (XOM): An energy company with a substantial dividend yield, influenced by oil price volatility.

Realty Income (O): A real estate investment trust (REIT) known for its monthly dividends and strong income focus.

4. Dividend ETFs

Dividend ETFs provide diversified exposure to dividend-paying stocks, offering convenience and reduced individual stock risk. Examples include:

Vanguard Dividend Appreciation ETF (VIG): Focuses on companies with a history of increasing dividends.

iShares Select Dividend ETF (DVY): Targets high-yield dividend stocks.

Schwab U.S. Dividend Equity ETF (SCHD): Tracks high-dividend-yielding U.S. companies.

Tools and Resources

1. Dividend Screeners

Online tools like Yahoo Finance, Morningstar, and Dividend.com offer dividend stock screeners to identify investment opportunities based on specific criteria.

2. Financial News and Analysis

Stay informed with financial news sources such as Bloomberg, CNBC, and The Wall Street Journal. These platforms provide updates on market trends, company performance, and economic factors influencing dividends.

3. Investment Research Platforms

Platforms like Seeking Alpha, Zacks, and Value Line offer in-depth research, analysis, and insights on dividend stocks and investment strategies.

4. Brokerage Research Tools

Many brokerage firms provide research tools, stock screeners, and educational resources to assist investors in building and managing dividend portfolios.

5. Dividend Reinvestment Plans (DRIPs)

DRIPs allow investors to automatically reinvest dividends into additional shares of the same stock. Many companies and brokerage firms offer DRIPs, facilitating compounding and portfolio growth.

Dividend investing offers a powerful strategy for generating income, achieving capital appreciation, and building wealth over the long term. By focusing on quality companies, diversifying your portfolio, reinvesting dividends, and staying informed, you can navigate the complexities of dividend investing and enhance your financial success.

Adopting a disciplined and patient approach, leveraging tools and resources, and continuously monitoring your investments will help you build a robust dividend portfolio that aligns with your financial goals and risk tolerance. Whether you are a novice investor or a seasoned pro, the principles and strategies outlined in this guide provide a solid foundation for successful dividend investing.