Managing personal finances can be a daunting task, but it is essential for building a secure and prosperous future. Despite best intentions, many people make financial mistakes that can have long-lasting consequences. In this comprehensive article, we will explore the top 10 financial mistakes to avoid and provide practical advice on how to steer clear of these common pitfalls. By understanding and avoiding these mistakes, you can set yourself on a path to financial stability and success.

Contents

- 1 1. Failing to Create and Follow a Budget

- 2 2. Living Beyond Your Means

- 3 3. Neglecting Emergency Savings

- 4 4. Ignoring Retirement Savings

- 5 5. Accumulating High-Interest Debt

- 6 6. Not Having Adequate Insurance

- 7

- 8 7. Overlooking the Importance of Credit Scores

- 9 8. Failing to Invest

- 10 9. Not Planning for Major Life Events

- 11 10. Lack of Financial Education

1. Failing to Create and Follow a Budget

The Importance of Budgeting

Budgeting is the cornerstone of financial management. It provides a clear picture of your income and expenses, helping you make informed decisions about your money. Without a budget, it is easy to overspend, accumulate debt, and lose track of your financial goals.

How to Create a Budget

Track Your Income and Expenses: Start by documenting all sources of income and categorizing your expenses. This includes fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

Set Financial Goals: Determine your short-term and long-term financial goals. This could include saving for a vacation, paying off debt, or building an emergency fund.

Allocate Funds: Assign a specific amount of money to each category based on your priorities and goals. Ensure that your expenses do not exceed your income.

Monitor and Adjust: Regularly review your budget to ensure you are staying on track. Adjust your spending as needed to align with your financial goals.

Common Budgeting Mistakes

Ignoring Small Expenses: Small, frequent purchases can add up quickly. Track every expense, no matter how minor.

Being Too Restrictive: A budget that is too tight can be hard to stick to. Allow some flexibility for occasional treats or unexpected expenses.

Not Adjusting for Changes: Life circumstances change, and so should your budget. Revisit and adjust your budget as needed.

2. Living Beyond Your Means

Understanding Lifestyle Inflation

Lifestyle inflation occurs when your spending increases as your income rises. While it is natural to want to improve your standard of living, excessive lifestyle inflation can lead to financial instability.

Signs You Are Living Beyond Your Means

Relying on Credit Cards: Frequently using credit cards to cover basic expenses can indicate that you are spending more than you earn.

No Savings: If you find it difficult to save money or have no emergency fund, you may be living beyond your means.

Constant Financial Stress: Feeling stressed or anxious about money is a sign that your expenses may be outpacing your income.

How to Avoid Lifestyle Inflation

Set Spending Limits: Establish limits for discretionary spending and stick to them, even if your income increases.

Prioritize Saving: Make saving a priority by setting aside a portion of your income before spending on non-essential items.

Evaluate Purchases: Before making a significant purchase, consider whether it is a need or a want. Delay non-essential purchases to ensure they fit within your budget.

3. Neglecting Emergency Savings

The Role of an Emergency Fund

An emergency fund is a savings buffer that provides financial security in the event of unexpected expenses, such as medical emergencies, car repairs, or job loss. Without an emergency fund, you may be forced to rely on credit cards or loans, leading to debt.

How Much to Save

Start Small: Aim to save at least $1,000 as a starter emergency fund.

Build Over Time: Gradually increase your emergency fund to cover three to six months’ worth of living expenses.

Strategies for Building an Emergency Fund

Automate Savings: Set up automatic transfers to your savings account to ensure consistent contributions.

Cut Unnecessary Expenses: Identify and eliminate non-essential expenses to free up money for savings.

Use Windfalls Wisely: Allocate bonuses, tax refunds, or other windfalls to your emergency fund.

4. Ignoring Retirement Savings

The Importance of Early Retirement Planning

Saving for retirement is crucial to ensure financial security in your later years. The earlier you start, the more time your money has to grow through compound interest.

Common Retirement Savings Mistakes

Delaying Contributions: Procrastinating on retirement savings can significantly reduce the amount of money available when you retire.

Not Taking Advantage of Employer Matches: If your employer offers a retirement plan with matching contributions, failing to contribute enough to get the full match is like leaving free money on the table.

Underestimating Retirement Needs: Many people underestimate how much they will need to maintain their desired lifestyle in retirement.

How to Save for Retirement

Start Early: Begin contributing to a retirement account as soon as possible, even if the amounts are small.

Maximize Contributions: Contribute the maximum allowable amount to tax-advantaged retirement accounts like 401(k)s or IRAs.

Diversify Investments: Spread your investments across different asset classes to reduce risk and increase potential returns.

5. Accumulating High-Interest Debt

The Dangers of High-Interest Debt

High-interest debt, such as credit card debt, can quickly spiral out of control due to compounding interest. The longer you carry a balance, the more interest you will pay, making it difficult to pay off the principal.

How to Avoid High-Interest Debt

Pay Off Balances in Full: Avoid carrying a balance on credit cards by paying off your full statement balance each month.

Limit Credit Card Use: Use credit cards only for necessary purchases that you can pay off immediately.

Seek Lower Interest Rates: If you already have high-interest debt, consider consolidating it into a lower-interest loan or using a balance transfer credit card with a lower rate.

Strategies for Paying Off Debt

Debt Snowball Method: Focus on paying off the smallest debts first while making minimum payments on larger debts. Once a debt is paid off, move on to the next smallest debt.

Debt Avalanche Method: Prioritize paying off debts with the highest interest rates first, which can save you more money in interest over time.

Negotiate with Creditors: Contact your creditors to negotiate lower interest rates or repayment terms.

6. Not Having Adequate Insurance

The Role of Insurance in Financial Planning

Insurance provides financial protection against unforeseen events, such as accidents, illnesses, or natural disasters. Without adequate insurance, you may face significant out-of-pocket expenses that can deplete your savings and jeopardize your financial stability.

Types of Essential Insurance

Health Insurance: Covers medical expenses, including doctor visits, hospital stays, and prescription medications.

Auto Insurance: Provides coverage for damages and injuries resulting from car accidents.

Homeowners or Renters Insurance: Protects against damage to your home or personal belongings due to theft, fire, or other covered events.

Life Insurance: Provides financial support to your dependents in the event of your death.

Disability Insurance: Replaces a portion of your income if you become unable to work due to illness or injury.

Tips for Choosing Insurance

Evaluate Coverage Needs: Assess your risks and determine the appropriate level of coverage for each type of insurance.

Compare Policies: Shop around and compare policies from different providers to find the best coverage at the most affordable price.

Review and Update Regularly: Periodically review your insurance policies to ensure they still meet your needs and make adjustments as necessary.

7. Overlooking the Importance of Credit Scores

Why Credit Scores Matter

Your credit score is a numerical representation of your creditworthiness and is used by lenders, landlords, and even employers to evaluate your financial responsibility. A good credit score can help you secure loans, credit cards, and favorable interest rates.

Common Credit Score Mistakes

Missing Payments: Late or missed payments can significantly impact your credit score.

High Credit Utilization: Using a large percentage of your available credit can lower your credit score.

Ignoring Credit Reports: Failing to review your credit reports can result in undetected errors or fraudulent activity.

How to Maintain a Healthy Credit Score

Pay Bills on Time: Consistently make on-time payments for all your bills and debts.

Keep Balances Low: Aim to use no more than 30% of your available credit limit.

Monitor Credit Reports: Regularly check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) for accuracy and dispute any errors.

8. Failing to Invest

The Benefits of Investing

Investing allows your money to grow over time, helping you build wealth and achieve financial goals. Relying solely on savings accounts, which typically offer low interest rates, may not keep pace with inflation, eroding the purchasing power of your money.

Common Investment Mistakes

Not Starting Early: Delaying investments can result in missed opportunities for growth through compound interest.

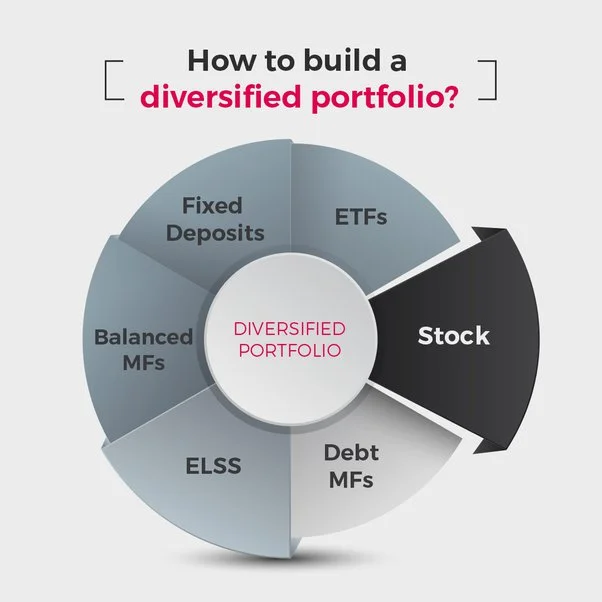

Lack of Diversification: Investing all your money in a single asset or sector increases risk.

Emotional Investing: Making investment decisions based on emotions, such as fear or greed, can lead to poor outcomes.

How to Start Investing

Educate Yourself: Learn about different investment options, such as stocks, bonds, mutual funds, and real estate.

Set Clear Goals: Determine your investment goals, risk tolerance, and time horizon.

Diversify Your Portfolio: Spread your investments across various asset classes to reduce risk.

Consider Professional Advice: Consult with a financial advisor if you need guidance on creating an investment strategy.

9. Not Planning for Major Life Events

The Financial Impact of Life Events

Major life events, such as marriage, having children, buying a home, or retirement, can have significant financial implications. Failing to plan for these events can lead to financial stress and instability.

How to Plan for Life Events

Create a Timeline: Identify major life events you anticipate and create a timeline for when they may occur.

Estimate Costs: Research and estimate the potential costs associated with each event.

Save and Invest: Set aside funds specifically for these events and invest them appropriately based on your timeline.

Review and Adjust Plans: Regularly review your plans and make adjustments as your circumstances change.

Common Life Events to Plan For

Marriage: Consider the costs of the wedding, merging finances, and potential changes in income or expenses.

Children: Plan for expenses related to childbirth, childcare, education, and extracurricular activities.

Homeownership: Save for a down payment, closing costs, and ongoing maintenance and property taxes.

Retirement: Ensure you have sufficient savings and investments to support your desired lifestyle in retirement.

10. Lack of Financial Education

The Importance of Financial Literacy

Financial literacy is the knowledge and skills needed to make informed and effective financial decisions. Without a solid understanding of personal finance, it is easy to make mistakes that can have long-term consequences.

How to Improve Financial Literacy

Read Books and Articles: There are numerous books, articles, and online resources dedicated to personal finance topics.

Take Courses: Enroll in financial literacy courses or workshops offered by community organizations, educational institutions, or online platforms.

Consult Professionals: Seek advice from financial advisors, accountants, or other financial professionals.

Stay Informed: Keep up with current financial news and trends to stay informed about changes that may affect your finances.

Key Areas of Financial Literacy

Budgeting and Saving: Understanding how to create and follow a budget, save money, and manage expenses.

Investing: Learning about different investment options, risk management, and strategies for growing wealth.

Credit Management: Knowing how to build and maintain a good credit score, manage debt, and use credit responsibly.

Insurance: Understanding the types and importance of insurance coverage to protect against financial loss.

Retirement Planning: Preparing for retirement by saving and investing wisely to ensure financial security in later years.

Avoiding these top 10 financial mistakes can significantly improve your financial health and help you achieve your long-term goals.

By creating and following a budget, living within your means, saving for emergencies and retirement, managing debt, securing adequate insurance, maintaining a good credit score, investing wisely, planning for major life events, and continuously improving your financial literacy, you can build a solid foundation for a secure and prosperous future.

Remember, financial success is a journey that requires ongoing effort, education, and discipline. Start today by evaluating your current financial habits and making the necessary changes to avoid these common pitfalls.