The stock market is a dynamic and complex environment where securities are bought and sold. Understanding stock market trends is crucial for investors aiming to make informed decisions and maximize their returns. This comprehensive article explores the nature of stock market trends, the factors influencing them, and strategies to navigate these trends effectively.

What Are Stock Market Trends?

Stock market trends refer to the general direction in which the market or a specific stock is moving over a period. They can be broadly categorized into three types:

Uptrends (Bull Markets): Characterized by rising stock prices, driven by investor optimism, strong economic indicators, and robust corporate earnings.

Downtrends (Bear Markets): Occur when stock prices are falling, often due to negative economic news, declining corporate earnings, or investor pessimism.

Sideways Trends (Consolidation): In a sideways trend, stock prices move within a narrow range without a clear direction. This phase typically occurs after significant moves in either direction, as the market consolidates before determining its next move.

Factors Influencing Stock Market Trends

Several factors influence stock market trends, including:

Economic Indicators: GDP growth, unemployment rates, inflation, and consumer spending significantly impact stock market trends. Strong economic indicators generally lead to bullish trends, while weak data can trigger bearish trends.

Corporate Earnings: The financial performance of companies, reflected in their quarterly earnings reports, is a major driver of stock prices. Positive earnings surprises can boost stock prices, while disappointing results can lead to declines.

Interest Rates: Central banks, such as the Federal Reserve, influence stock market trends through their monetary policies. Lower interest rates generally stimulate economic growth and boost stock prices, while higher rates can have the opposite effect.

Geopolitical Events: Political stability, international trade agreements, and geopolitical conflicts can affect investor confidence and market trends. For example, trade wars or political unrest can lead to market volatility and downtrends.

Market Sentiment: Investor sentiment, driven by psychological factors and market psychology, plays a crucial role in shaping market trends. Fear and greed are powerful emotions that can lead to overreactions and exaggerated market movements.

Types of Stock Market Trends

Stock market trends can be analyzed over different timeframes, each offering unique insights into market behavior:

Short-Term Trends: These trends last from a few days to a few weeks and are often driven by news events, earnings reports, or changes in investor sentiment. Short-term trends can be volatile and are of particular interest to day traders and swing traders.

Intermediate-Term Trends: Spanning several weeks to a few months, intermediate-term trends reflect broader market movements and are influenced by economic data, corporate earnings, and central bank policies. Investors with a medium-term horizon often focus on these trends.

Long-Term Trends: These trends extend over several months to years and are shaped by fundamental factors such as economic cycles, technological advancements, and demographic shifts. Long-term trends are crucial for long-term investors and provide insights into the overall direction of the market.

Technical Analysis and Stock Market Trends

Technical analysis is a popular method used by investors to identify and interpret stock market trends. It involves analyzing historical price data, volume, and various technical indicators to forecast future price movements. Key tools and concepts in technical analysis include:

Trendlines: Trendlines are drawn on price charts to identify the direction of the trend. An upward trendline connects a series of higher lows, while a downward trendline connects lower highs.

Moving Averages: Moving averages smooth out price data to identify the overall trend. The 50-day and 200-day moving averages are commonly used to spot long-term trends.

Relative Strength Index (RSI): RSI measures the speed and change of price movements to identify overbought or oversold conditions. An RSI above 70 indicates overbought conditions, while an RSI below 30 indicates oversold conditions.

MACD (Moving Average Convergence Divergence): MACD is a momentum indicator that shows the relationship between two moving averages. It helps identify trend reversals and the strength of the trend.

Support and Resistance Levels: Support levels are price points where buying pressure prevents further declines, while resistance levels are where selling pressure prevents further advances. These levels help identify potential entry and exit points.

Fundamental Analysis and Stock Market Trends

While technical analysis focuses on price patterns, fundamental analysis examines the intrinsic value of stocks based on economic and financial data. Key aspects of fundamental analysis include:

Earnings Per Share (EPS): EPS is a measure of a company’s profitability and is calculated by dividing net income by the number of outstanding shares. Higher EPS indicates better financial performance.

Price-to-Earnings Ratio (P/E Ratio): The P/E ratio compares a company’s stock price to its earnings per share. A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may suggest it is undervalued.

Dividend Yield: Dividend yield measures the annual dividend payment as a percentage of the stock price. It is an important metric for income-focused investors.

Revenue Growth: Consistent revenue growth indicates a company’s ability to expand its operations and increase market share. It is a positive sign for long-term investors.

Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholders’ equity. A lower ratio suggests a stronger financial position and lower risk.

Strategies for Investing in Stock Market Trends

Investing in stock market trends requires a strategic approach tailored to individual goals, risk tolerance, and investment horizon. Some common strategies include:

Trend Following: This strategy involves investing in stocks that are trending in a particular direction, either upward or downward. Trend followers use technical indicators to identify entry and exit points and aim to capitalize on sustained market movements.

Value Investing: Value investors seek to identify undervalued stocks with strong fundamentals. They look for companies trading below their intrinsic value and hold these stocks until the market recognizes their true worth.

Growth Investing: Growth investors focus on companies with high growth potential. They prioritize revenue and earnings growth over current valuation and are willing to pay a premium for stocks with strong future prospects.

Contrarian Investing: Contrarian investors go against prevailing market trends by buying stocks that are out of favor and selling those that are popular. This strategy requires a deep understanding of market psychology and patience.

Sector Rotation: Sector rotation involves shifting investments between different sectors based on economic cycles and market trends. Investors move capital into sectors expected to outperform and reduce exposure to sectors likely to underperform.

The Role of Market Cycles

Market cycles are recurring periods of expansion and contraction in the stock market, influenced by economic and business cycles. Understanding market cycles is crucial for interpreting stock market trends and making informed investment decisions. The four phases of market cycles are:

Accumulation Phase: This phase occurs after a market downturn when prices are low, and investor sentiment is negative. Savvy investors start buying undervalued stocks in anticipation of a market recovery.

Markup Phase: During this phase, stock prices begin to rise as positive economic data and corporate earnings boost investor confidence. The market experiences increasing buying pressure, and the uptrend gains momentum.

Distribution Phase: In this phase, stock prices reach their peak, and early investors start selling their holdings to lock in profits. Market sentiment remains positive, but the pace of price increases slows down.

Markdown Phase: This phase follows the market peak, characterized by declining stock prices and negative investor sentiment. Selling pressure increases, and the market enters a downtrend until it reaches a bottom, leading to the next accumulation phase.

Behavioral Finance and Stock Market Trends

Behavioral finance studies the impact of psychological factors on investor behavior and market trends. Common biases and emotions that influence stock market trends include:

Herding Behavior: Investors tend to follow the actions of the majority, leading to trends driven by collective behavior rather than rational analysis. This can result in bubbles during uptrends and panic selling during downtrends.

Overconfidence: Overconfident investors may underestimate risks and overestimate their ability to predict market movements. This can lead to excessive trading and higher exposure to market volatility.

Loss Aversion: Investors are generally more sensitive to losses than gains, leading to risk-averse behavior. This can result in selling winning stocks too early and holding onto losing stocks for too long.

Anchoring: Investors may rely too heavily on initial information or past prices when making decisions. This can lead to biased assessments of a stock’s value and resistance to changing market conditions.

Confirmation Bias: Investors tend to seek out information that confirms their existing beliefs and ignore contradictory evidence. This can reinforce existing trends and lead to misguided investment decisions.

Practical Tips for Navigating Stock Market Trends

To effectively navigate stock market trends, investors should consider the following practical tips:

Stay Informed: Keep abreast of economic data, corporate earnings, and geopolitical events that can influence market trends. Regularly review financial news and market analysis from reputable sources.

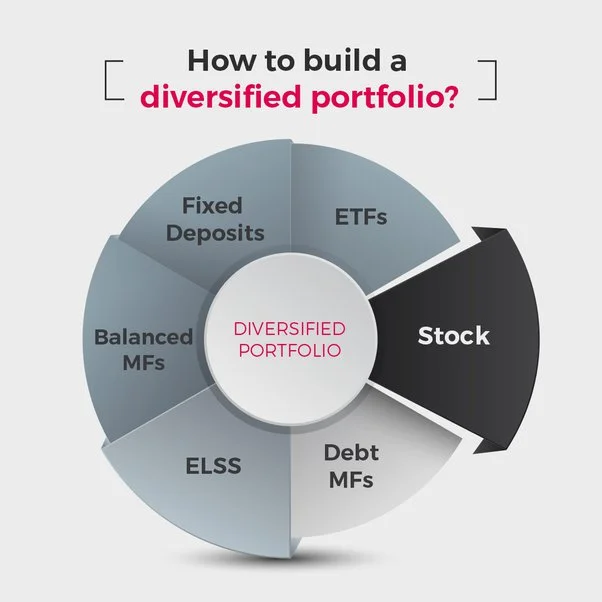

Diversify Your Portfolio: Diversification reduces risk by spreading investments across different asset classes, sectors, and geographic regions. A well-diversified portfolio is more resilient to market volatility.

Set Clear Goals: Define your investment objectives, risk tolerance, and time horizon. Having clear goals helps you stay focused and make rational decisions during market fluctuations.

Maintain a Long-Term Perspective: While short-term trends can be volatile, focusing on long-term trends helps investors avoid emotional decisions based on temporary market fluctuations.

Use Stop-Loss Orders: Practical Tips for Navigating Stock Market Trends (Continued)

Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses by automatically selling a stock when it reaches a predetermined price. This helps protect your portfolio from significant declines.

Regularly Review and Adjust Your Portfolio: Periodically review your investments to ensure they align with your goals and the current market environment. Adjust your portfolio as needed to stay on track.

Stay Disciplined: Avoid making impulsive decisions based on short-term market movements. Stick to your investment strategy and remain disciplined to achieve long-term success.

Educate Yourself: Continuously improve your knowledge of the stock market, investment strategies, and financial analysis. The more informed you are, the better equipped you’ll be to navigate market trends.

The Role of Technology in Understanding Stock Market Trends

Advancements in technology have transformed the way investors analyze and interpret stock market trends. Key technological tools and resources include:

Algorithmic Trading: Algorithmic trading uses computer algorithms to execute trades based on predefined criteria. These algorithms can analyze vast amounts of data and execute trades at high speeds, helping investors capitalize on market trends.

Robo-Advisors: Robo-advisors provide automated investment advice and portfolio management services. They use algorithms and data analysis to create and manage investment portfolios, making it easier for investors to stay aligned with market trends.

Financial News Apps: Mobile apps and online platforms provide real-time financial news, market data, and analysis. Staying informed about the latest developments can help investors make timely decisions based on current market trends.

Technical Analysis Software: Various software tools offer advanced charting capabilities, technical indicators, and pattern recognition features. These tools help investors analyze market trends and identify potential trading opportunities.

Social Media and Online Communities: Social media platforms and online investment communities offer valuable insights and perspectives from other investors. Engaging with these communities can provide additional context and analysis of market trends.

Understanding stock market trends is essential for making informed investment decisions and achieving long-term financial success. By recognizing the different types of trends, analyzing the factors influencing them, and employing effective strategies, investors can navigate the complexities of the stock market with confidence. Whether using technical analysis, fundamental analysis, or a combination of both, staying informed and disciplined is key to capitalizing on market trends. Embrace the advancements in technology to enhance your analysis and decision-making process, and always keep learning to stay ahead in the ever-evolving world of stock market investing.